Slower Spending Growth In Q3

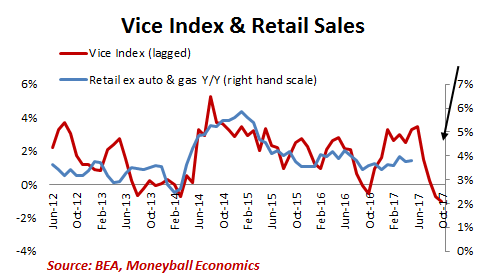

When Vice spending momentum began to slow in February, I blamed near-term noise. I thought it might be tied to February’s tax refund deferral.

And when it slowed again in March, I blamed Easter.

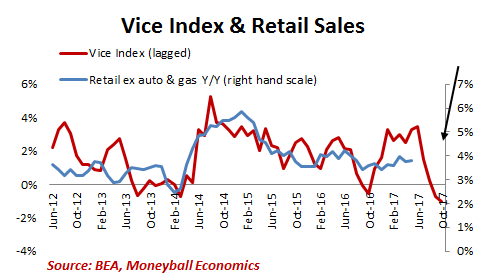

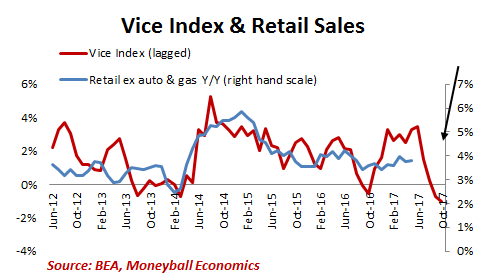

But vice spending growth continues to slow. In fact, in the latest month, it points to contraction in 3Q or early 4Q.

And we’re already seeing that slowdown in the latest Retail data. May retail spending downshifted significantly:

Recent Macro Data Confirms the Downshift

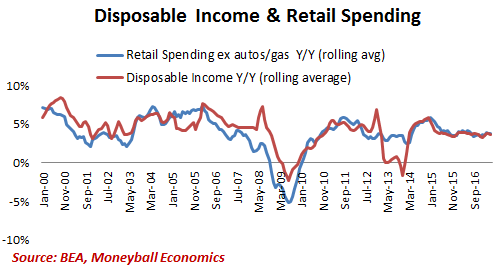

People spend what they earn.

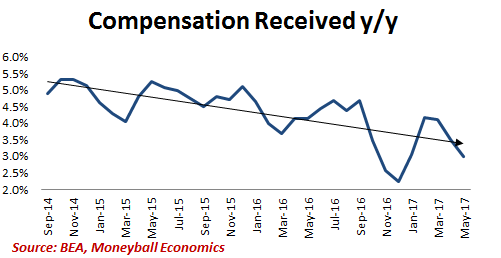

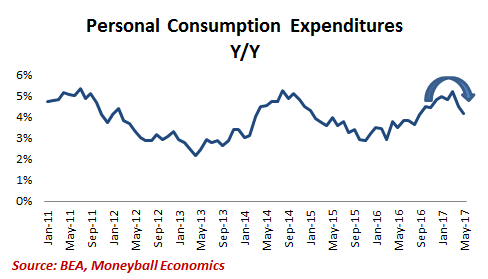

As income growth slowed, so have Personal Consumption Expenditures (PCE). And this is after gas price inflation has moderated.

Spending could rise if wage inflation picks up. Or if payroll growth accelerates (or both). But that scenario is unlikely in 2017.

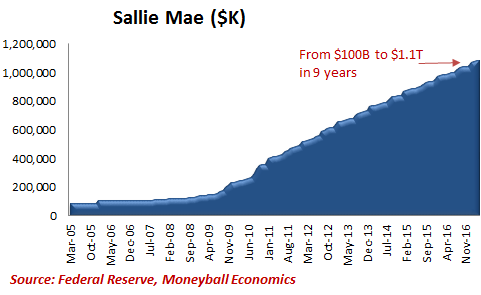

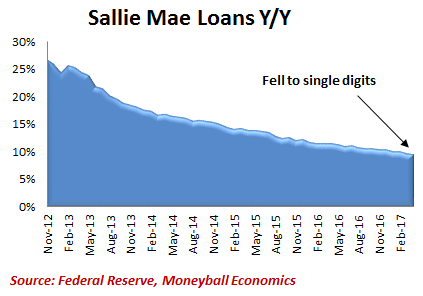

Meanwhile, alternative sources of money are slowing. The biggest being student loans.

Student loans are the biggest scam going: money is given but only a fraction goes to tuition. The rest has been recycled into the consumer economy via cars, vacations, iPhones, and so on.

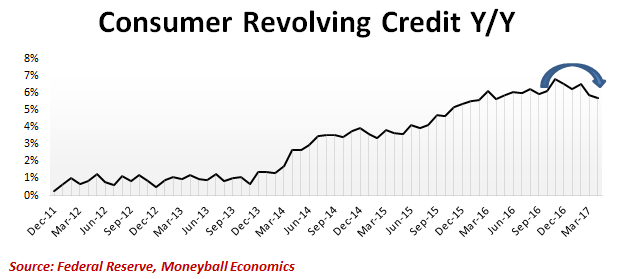

Revolving credit has also rolled over.

Add it all up and conditions are set for slower spending growth.

It’s already showing up in the luxury spending we call vices.

Like in Gambling & Prostitution

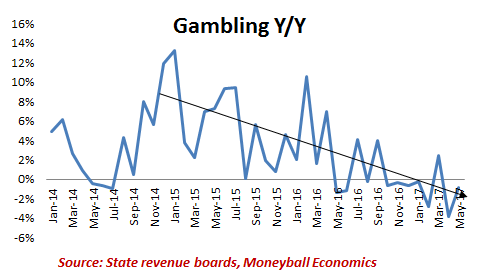

Gambling Continues To Slow

The above chart averages the rates of gambling growth for Detroit, Maryland, Connecticut, Atlantic City, &Pennsylvania.

While comps play a role in exaggerating some of the contraction, the trend is clear:less gambling. And that means less hot money floating around households to play with.

But it’s even more obvious in the middle and upper ends of the market. Take Las Vegas: the Downtown area caters to more lower-income gamblers. The Strip is for the middle and upper income gamblers.In the latest month, Downtown gambling rose 9% while Strip gambling rose 3%.

Leave A Comment