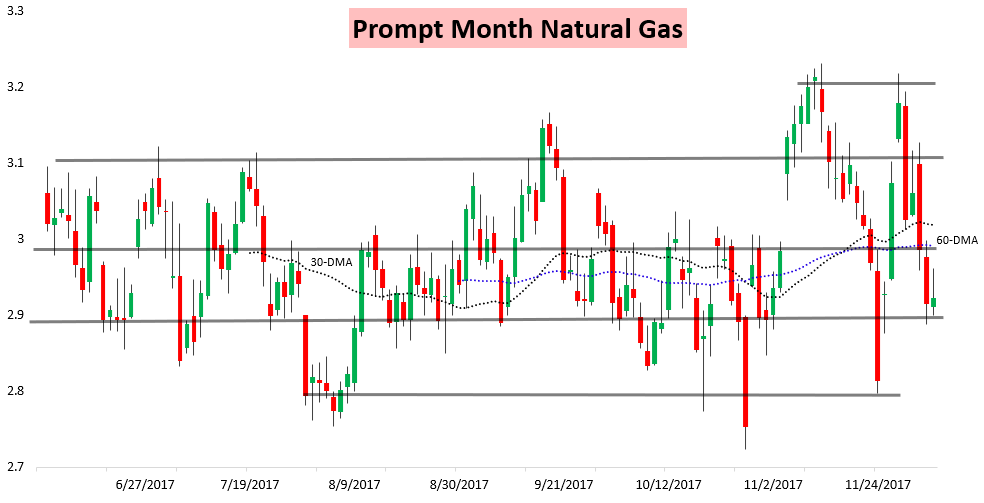

After a couple days of heavy selling, natural gas prices settled down today, trading within a more narrow 7.7-cent range. Prices closed up slightly on the day, though were up more significantly this morning before being hit by another round of mid-morning selling.

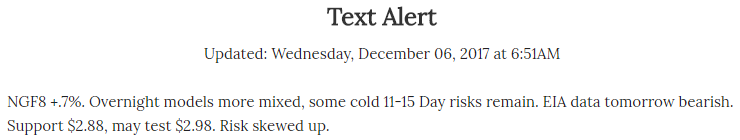

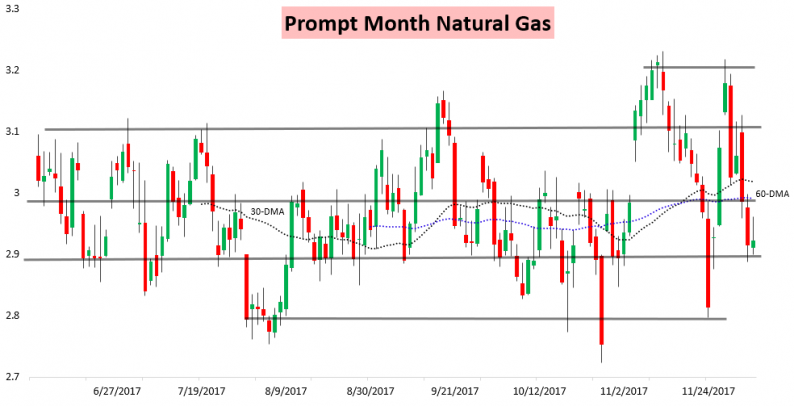

Prices were able to bounce cleanly off $2.88 support again today, something we highlighted for clients in our pre-7 AM Eastern Morning Text, but they did not quite reach the $2.98 resistance level we had expected them to as sellers hit prices just after 9 AM.

It was certainly not surprising that today was the first day natural gas prices were able to find a footing, however. As long ago as last Friday in our Pre-Close Update we were warning clients that today we expected to see the first real cash reaction to incoming cold, and that we could end up seeing that support the natural gas market.

This is exactly what happened, with physical day-ahead Henry Hub cash prices gaining modestly on the day, though futures only garnered support from this as morning selling ensured there was no real sustained bump in prices.

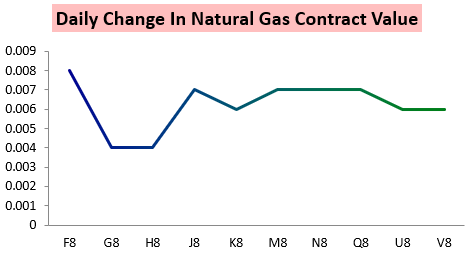

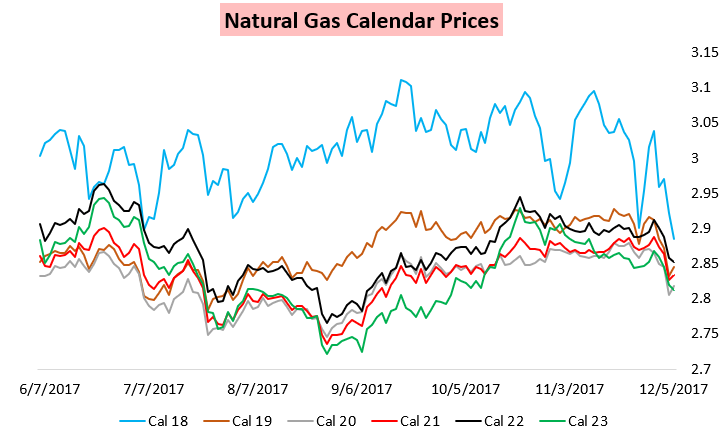

In fact, gains across the natural gas strip today were rather consistent (albeit small). We noticed some losses much further out along the strip, and earlier this morning it was later contracts that seemed to drag down the front of the strip, indicating it was more balance than weather driving price action.

Such price action should not be all that surprising, as in recent selling later natural gas contracts have come under sizable pressure. We did note this morning that yesterday the later natural gas calendar strips found a bit of support even as the 2018 calendar strip sold off, seeming to indicate that the market was succeeding in pricing in recent loosening.

But again today we saw balance-driven selling erase early natural gas gains, even as weather forecasts were little-changed. We monitored this closely today, and it allowed us to properly alert clients late this morning in our Note of the Day that $2.88 support would likely hold in the face of heavy selling.

Leave A Comment