It was a post-Labor Day bloodbath for natural gas prices, as the October natural gas contract plummeted over 3%.

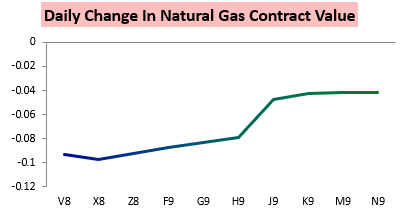

Winter natural gas contracts did not fare much better today, with the November contract actually logging the largest loss on the day.

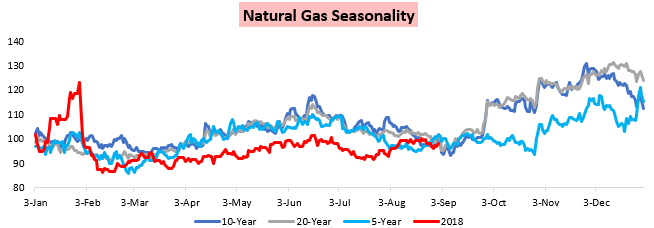

This move was far from a surprise for subscribers; in our Friday Pre-Close Update we highlighted that our natural gas sentiment had turned slightly bearish as we saw at least $2.85 likely to be tested due to holiday demand destruction loosening weather-adjusted power burns and seasonality turning very bearish.

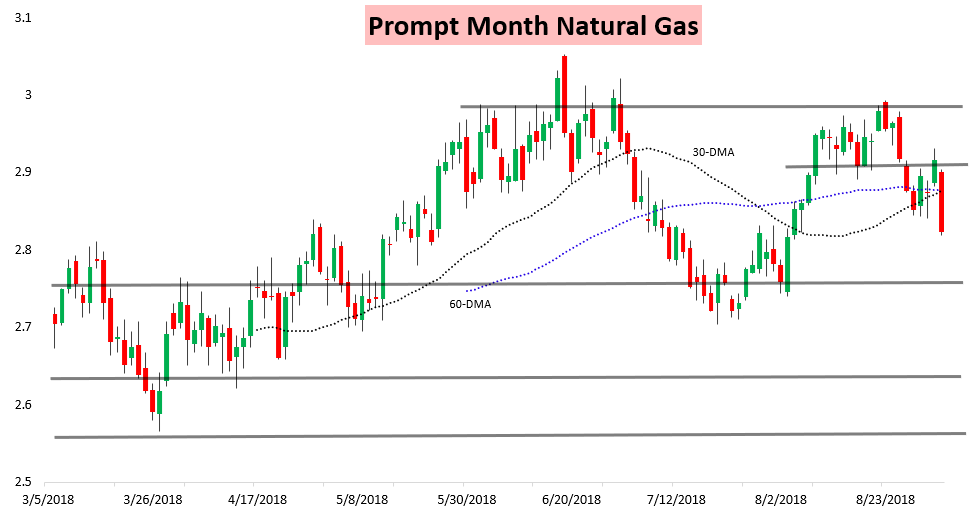

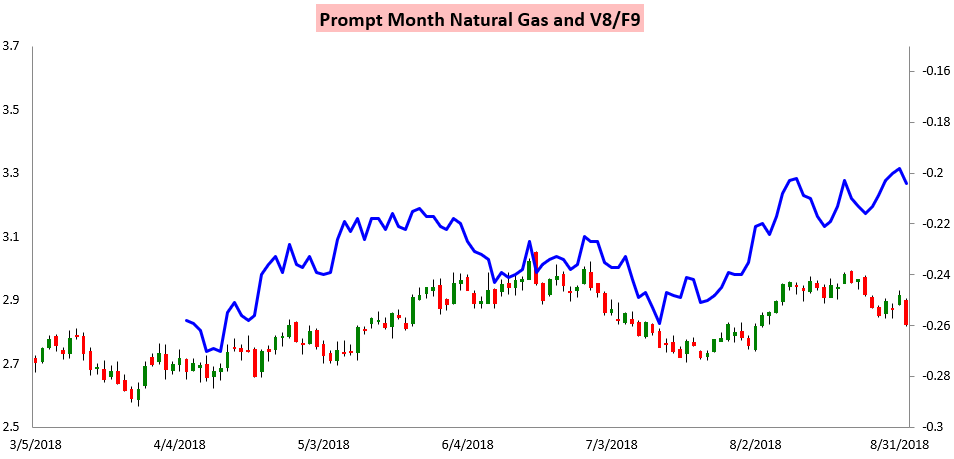

Those trends played out today and led to price action whereby the prompt month natural gas contract is off 16 cents from recent highs but V/F is still near recent narrow levels.

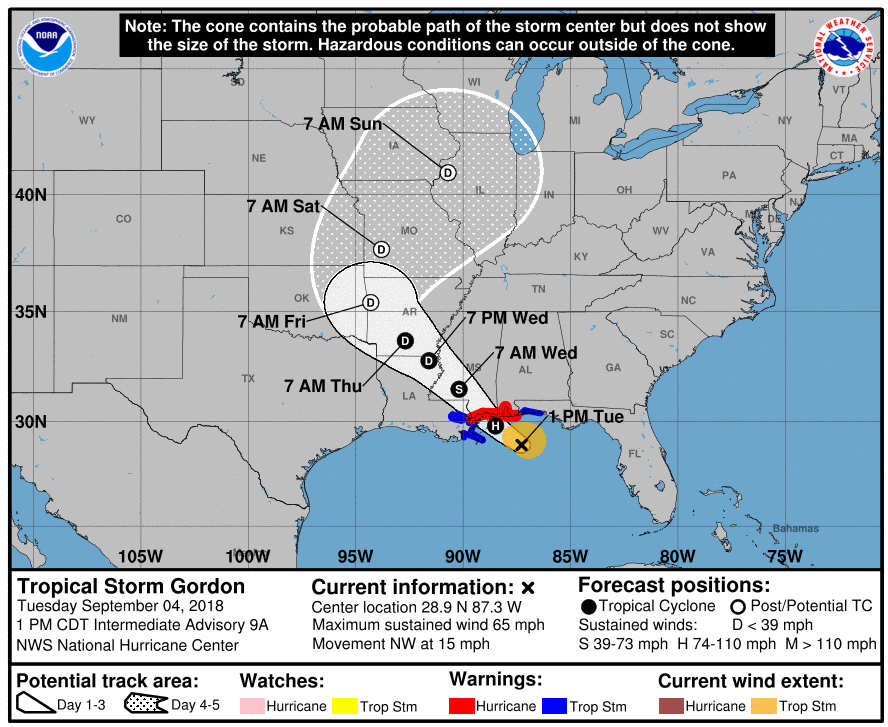

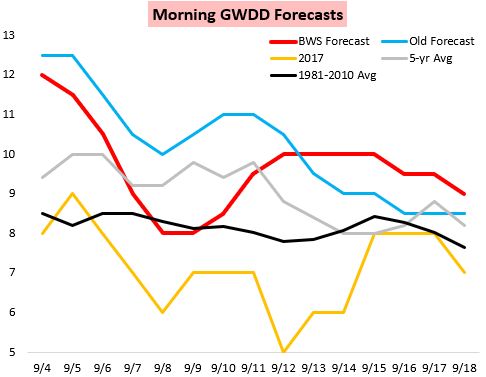

These bearish trends for natural gas were furthered by significant cooling demand losses in the coming week due to Tropical Storm Gordon coming onshore along the Gulf Coast and only slowly moving across the center of the country.

This played a large role in the GWDD losses we outlined in our Morning Update for clients as likely to keep natural gas risk skewed lower through the day today.

Traders are now trying to determine where a floor is for prices, and in our Note of the Day today we looked at the latest weather-adjusted balances to see where support could begin to be found and how we compared to the rest of the summer. Then in our Afternoon Update we looked at the latest weather forecasts and trends along the natural gas strip to determine how price risk was skewed into Thursday’s EIA print.

Leave A Comment