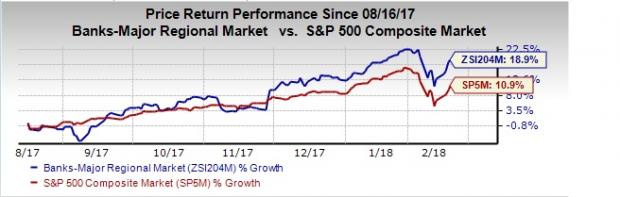

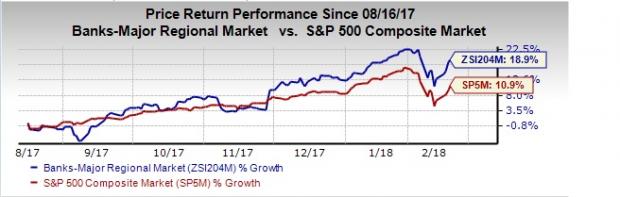

Over the last five trading days, performance of banking stocks has been bullish. The 10-year Treasury bond yields escalated at four-year highs on higher-than-expected inflation. Positive economic growth, along with central banks’ moves globally to improve interest rates from ultra-low levels, boosted yields which supported bank stocks, encouraging investors to focus more on bank stocks.

Additionally, investors’ confidence received a boost from President Trump’s much-awaited $200-billion infrastructure plan that rolled out earlier this week.

Mortgage rates were also on an upswing, hitting a nearly four-year high of 4.38%, as money was pulled out of the bond market. However, homeowners seeking lower rates for refinancing are definitely big-time losers. Increase in mortgage rates will limit reduce refinancing activity.

Further, strategies to enhance profitability through streamlining operations, and resolution of litigation and probes related to legacy matters and business misconducts persisted in the last five trading days.

(Read: Bank Stock Roundup for the week ending Feb 9, 2018)

Important Developments of the Week

1. Wells Fargo (WFC – Free Report) entered into an agreement with Popular (BPOP –Free Report) to divest certain assets and liabilities of its auto finance business in Puerto Rico. The all-cash deal is expected to close by mid-2018. Wells Fargo’s auto lending segment landed in trouble last year when its customers were financially hurt due to issues related to auto Collateral Protection Insurance policies. The deal has been valued at $1.7 billion which reflects a 4.5% discount on the value of assets that are to be sold. (Read more: Wells Fargo to Divest Assets of Auto Lending Segment)

2. Citigroup (C – Free Report) is planning to open an innovation center in London, the first strategic step by a U.S. banking giant in the area post Brexit. Jim Cowles, CEO of operations in Europe, Middle East and Africa regions said that Citigroup will hire about 60 technologists for the center. The new lab will support the bank’s global markets and securities services business, and will be part of a network that already employs more than 250 people in labs from Ireland to Israel, Singapore and Mexico.

Leave A Comment