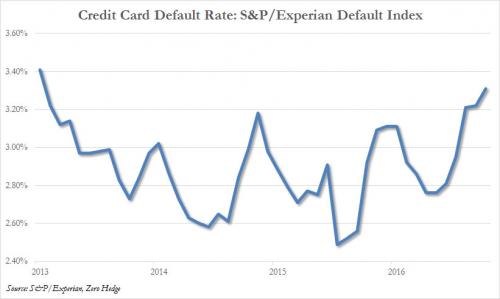

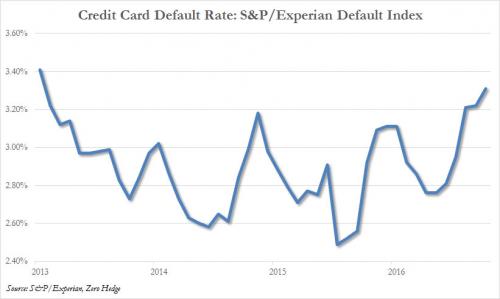

“Credit risk is ricocheting back as a legitimate concern after years of hibernation…” warns David Hendler, founder, and principal at Viola Risk Advisors, who considers recent share sales by executives at the big retail banks, in particular, to be smart, as consumer portfolios are showing signs of strain.

Wall Street analysts have been urging investors all year to buy stocks in the big US banks, but, as The FT reports, Wall Street itself is not listening.

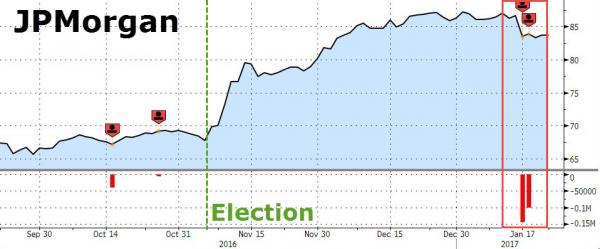

We noted at the start of the year that executives of the biggest TBTF banks were dumping their shares as a post-Trump rally took their stock prices higher…

And now, as The FT reports,, it continues to gather pace. Insiders at the big six banks by assets — JPMorgan Chase, Bank of America, Wells Fargo, Citigroup, Goldman Sachs and Morgan Stanley — have in total sold a net 9.32m shares on the open market since the turn of the year. Even excluding Warren Buffett’s big dumping of shares in Wells in April, to avoid tripping over rules capping ownership by a non-bank, sales by insiders outnumber purchases by about 14 to one.

That is an unusually long streak of net sales, across each of the big six.

Last year, for example, insiders at JPMorgan, Citigroup, and Bank of America bought more shares than they sold.

Buying and selling of shares by bank insiders can have a powerful signaling effect.

Last year Jamie Dimon, chairman and chief executive of JPMorgan, seemed to call an end to a mini-rout in bank stocks when he bought half a million shares in his own bank in mid-February.

But there have been no similar demonstrations of faith by senior insiders this year, suggesting they fear that the big gains under Mr. Trump have come to an end.

Insiders at Goldman and Morgan Stanley have made no open-market purchases this year, according to the Bloomberg data.

Leave A Comment