Hedge fund’s Q3 trades are now public following the release of 13F forms filed with the SEC. This means that now is the time to track the “Smart Money” of hedge fund gurus like Warren Buffett and Carl Icahn. Here we searched for stocks with both a positive hedge fund signal and a ‘Strong Buy’ best analyst consensus:

Using our big data analytics, we can also track the stock’s overall outlook from the Street. This gives us a better idea of whether these stocks make compelling investment opportunities. Bearing that in mind, let’s now take a closer look at these 5 top stocks.

1. Apple (NASDAQ:AAPL)

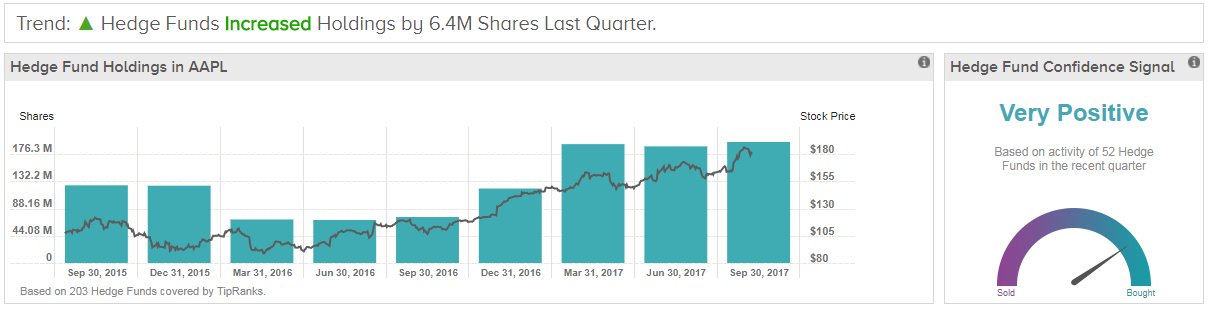

Hedge funds continue to boost holdings in tech giant Apple. The world’s most famous fund manager, Warren Buffett, now has a huge AAPL position of over $20 billion. In Q3, he increased Berkshire’s AAPL holding for the fifth time since coming late to the stock in 2016. Three other fund managers also have $1 billion + AAPL positions: Ken Fisher (Fisher Asset Management); Lisa M Jones (Pioneer Investment) and Philippe Laffont (Coatue Management).

“We were the first on Wall Street to project that Apple would reach a $1 trillion market cap as reflected by a price target; our current price target of $235.00 equates to approximately a $1.2 trillion market cap” says top Drexel Hamilton analyst Brian White. His bullish $235 price target is AAPL’s highest yet and projects a 38% rise in the next 12 months.

You can click on the screenshot for further insights into which hedge funds are buying AAPL right now.

2. Applied Materials (NASDAQ:AMAT)

Chip gear maker AMAT is ticking all the boxes right now. In Q3, hedge funds snapped up 5.9 million more Applied Materials shares. Zero hedge funds exited the stock and only 5 reduced positions vs 18 who increased holdings. UK-based fund manager Egerton’s John Armitage upped his position by 23% to $883 million- making this the fund’s third biggest stock after Comcast and Charter Communications.

Leave A Comment