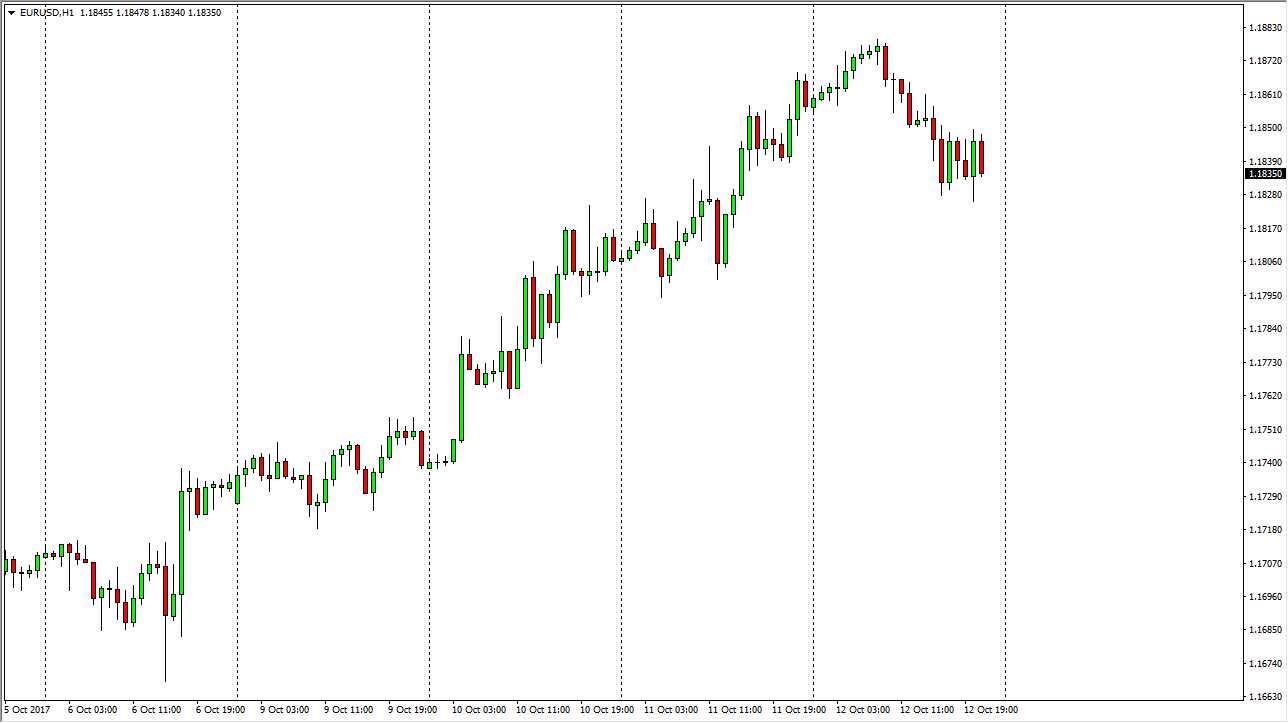

EUR/USD

The EUR/USD pair tried to rally initially on Thursday but then turned around to form a slightly negative candle. I think that the market is trying to go higher though, so pullbacks that show signs of support are opportunities to go long, perhaps reaching towards the 1.20 level. That’s an area that should offer resistance, and perhaps a longer-term target. I think that there is a lot of noise just above that area, so I think that it will take several attempts to get above there, and then perhaps go to the 1.25 level over the longer term. That is the target based on the recent breakout, as that’s what the latest moved measured for. I think that volatility continues, but there should be plenty of upward pressure going forward.

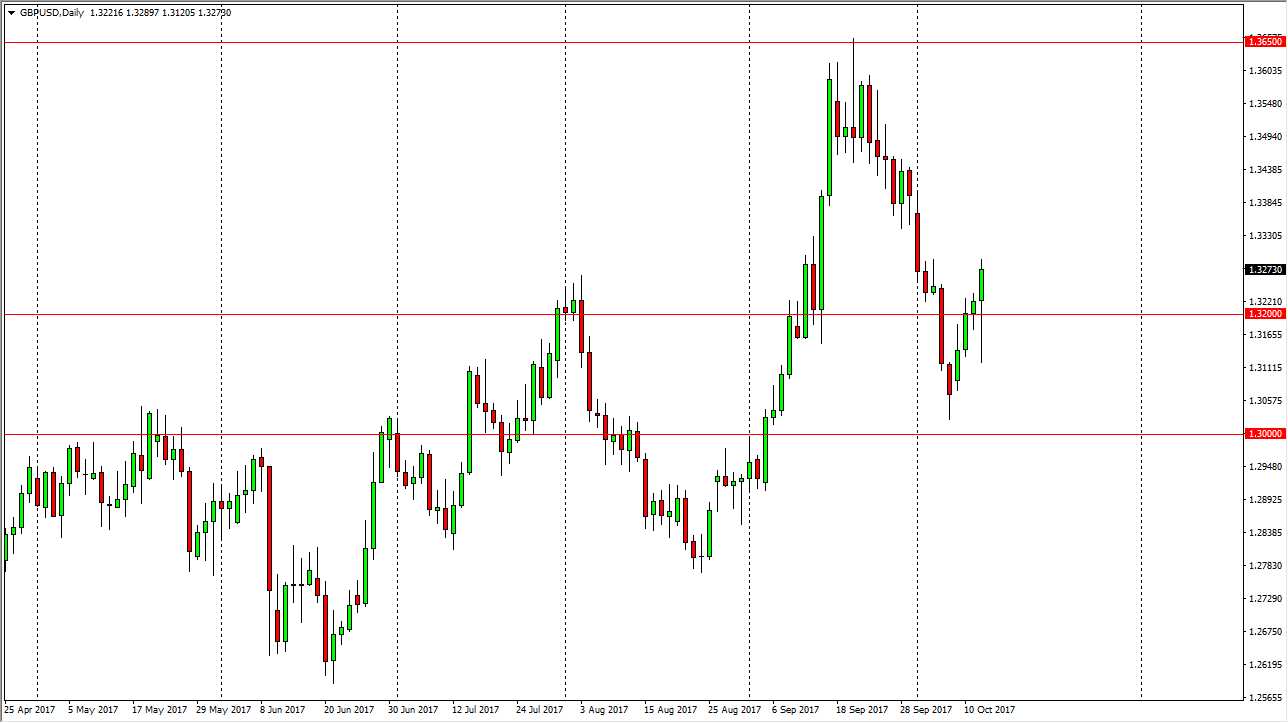

GBP/USD

The British pound continues to act as if it’s on fire, initially dropping significantly, breaking down below the 1.32 level. We found enough support at the 1.31 level underneath to turn things around and break above the 1.32 handle, and reaching towards the 1.33 level. If we can break above the 1.33 level, I think that the market continues to go to the 1.3650 level above which was the scene of the gap lower from the surprise a vote to leave the European Union. That is my target, and after forming the massive hammer during the session on Thursday, I think a break above the 1.33 level is reason enough to go long. I don’t have any interest in shorting this market, not after the massive move that we have had during the day on Thursday, and the scenes of support that have obviously shown themselves.

Leave A Comment