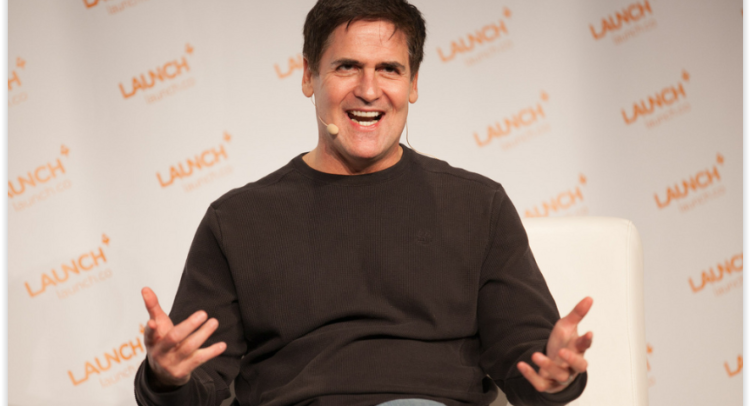

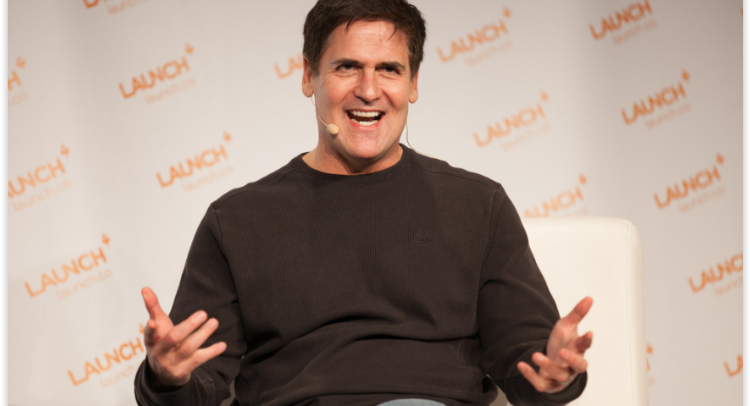

‘Shark tank’ investor Mark Cuban knows a thing or two about making money. So when he speaks, investors listen. And now he has revealed some of his favorite stock bets. There aren’t many of them, but here they are:

“I’m down to maybe four dividend-owning stocks, two shorts, and Amazon and Netflix. I’ve got a whole lot of cash on the sidelines,” Cuban told CNBC.” “[I’m] ready, willing and able if something happens” to invest.

“If I get a feeling that [economic] growth will continue at 4-plus percent and the debt will then come down, then I’ll get back into the market,” said Cuban.

With this in mind, we turned to Wall Street’s finest to see what market experts make of these two top stock pics.

So should you follow Cuban’s lead? Let’s take a closer look now:

Amazon (Nasdaq: AMZN)

Clearly, Mark Cuban and the Street are of one mind when it comes to Amazon. This is still one of the Street’s favorite stocks. In the last three months, 35 analysts have published AMZN Buy ratings. This is versus just 2 Hold ratings. Plus- even though the stock now trades at over $1,900- analysts still see further upside potential of over 10%.

But its Amazon’s future growth prospects that are exciting analysts right now. Piper Jaffray’s Michael Olson (Profile & Recommendations) has one of the best rankings on TipRanks. And he has just released a very bullish report on Amazon’s advertising potential.

According to Olson, advertising could be the next major growth driver for Amazon. “By 2020, we expect Amazon ad revenue of $16 billion and by 2021, beyond the scope of our current model, we believe it is highly likely that profits contributed from advertising will exceed those from ASW,” Olson wrote in a note to clients.

“Said differently, investors should be focused on Amazon advertising now; this is a major driver to results and valuation today and continuing in coming quarters and years.” In 2018 alone, Olson is now predicting ad revenue of about $8 billion in 2018, which could return over $3 billion in operating profit.

Leave A Comment