Bitcoin continued its gradual climb over the weekend, extending the recovery. So far, the moves have been steady-handed. What could boost the BTC/USD into overdrive?

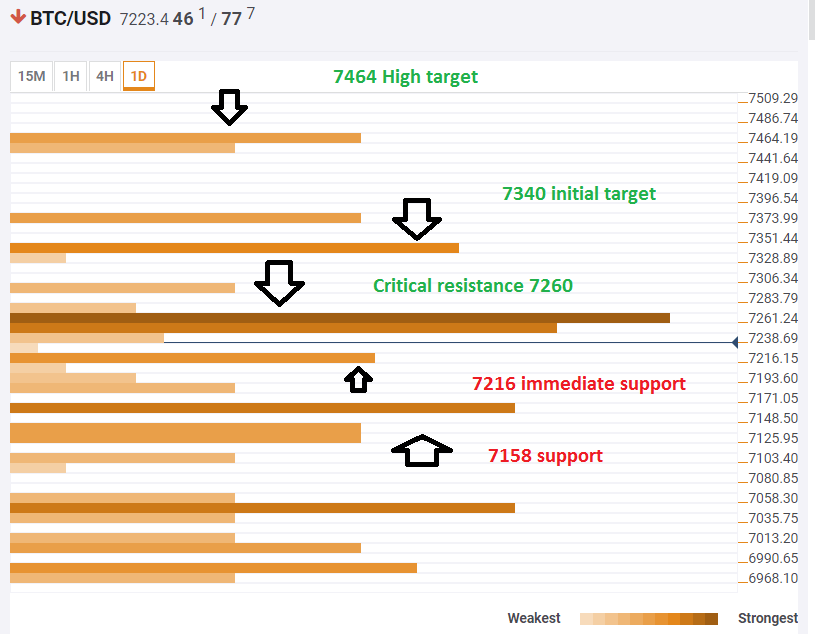

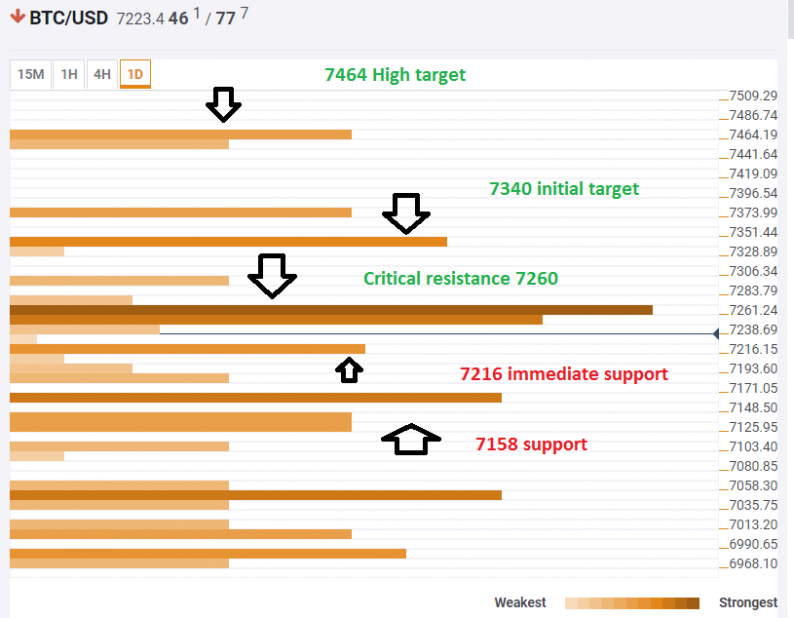

The Technical Confluence Indicator shows that Bitcoin faces a significant congestion of resistance levels at $7260 were we see the Simple Moving Average 100-15m, BB 15m-Upper, the Fibonacci 38.2% one-day, the 4h-high, the BB 1h-Middle, the SMA 10-1h, the SMA 10-4h, the Pivot Point one-week Resistance 1, and the SMA 50-15m.

The next target above is $7,340 which is the one-day high and the BB one-day Upper. There are very few distinct lines above, but the next goal would be the $7,464 level which is the Pivot Point one-week Resistance 2 and the PP one-day Resistance 2.

Immediate support awaits at $7,216 which is the meeting point of the BB 15m-Lower, the 1h-Low, the Fibonacci 61.8%, the SMA 200-15m, and the SMA 50-1h.

Lower, $71,58 is the meeting point of last month’s high, and it is backed up by the BB 4h-Middle, and the one-day low.

Here is how it looks on the tool:

The Confluence Detector finds exciting opportunities using Technical Confluences. The TC is a tool to locate and point out those price levels where there is a congestion of indicators, moving averages, Fibonacci levels, Pivot Points, etc. Knowing where these congestion points are located is very useful for the trader, and can be used as a basis for different strategies.

Leave A Comment