Bitcoin has over the past few years has had its ups and downs. From being touted as the new transaction currency, breaking away from the traditional currencies, to being used as a prime currency for running an underground drug market called Silk Road, Bitcoin seems to have come a full circle. Bitcoin has over the years been regarded as a currency, which should bring down transaction costs and stay away from all kinds of regulatory hurdles, has its own share of issues.

One of the biggest problems surrounding the crypto-currency has been security, as the industry is filled data breaches. The biggest example was Bitcoin exchange Mt. Gox closing its door and filing for bankruptcy. Over a period of time however, Bitcoin attracted mainstream retail giants such as eBay and PayPal. Not only big retail giants adopted Bitcoin thanks to its ease of use but small businesses across the world are now gradually accepting the digital currency.

The reason, according many small business owners is its ease of use and low transaction costs. It is imperative to state, since 2013 more than 150,000 businesses adopted the crypto-currency. Additionally, people residing in countries where traditional currencies lost significant value, such as Greece and Argentina started becoming Bitcoin users. Bitcoin has in fact been able to move above the so called “dollar syndrome” and is now being traded against many currencies, which is an undoubtedly positive sign.

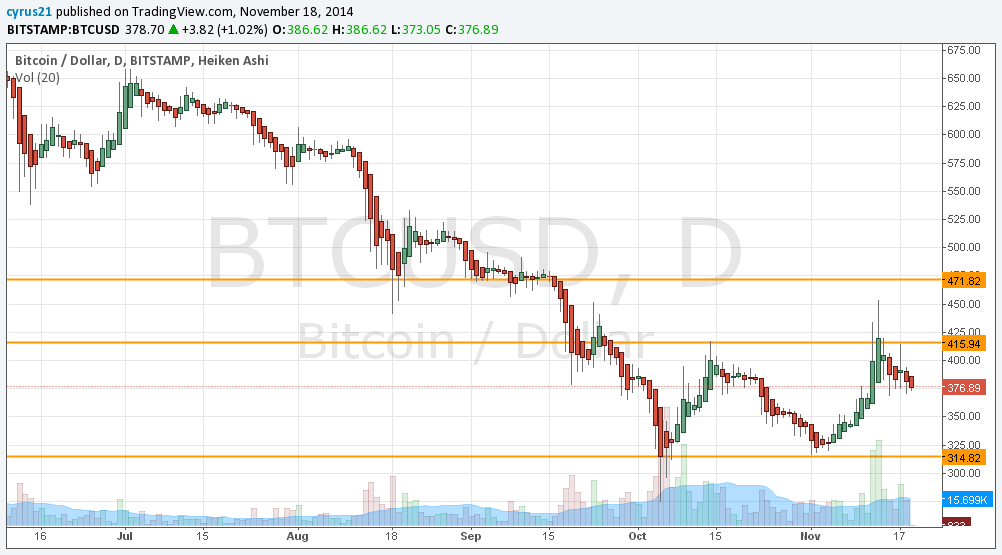

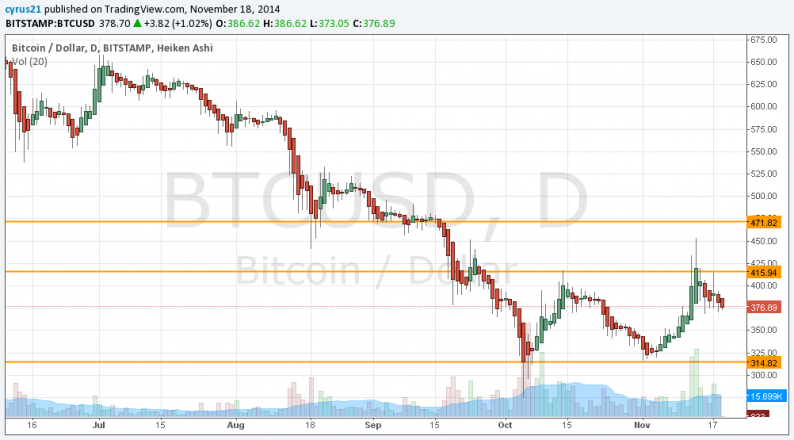

Technicals:

When looking at the above chart, every time the BTC/USD tried to move past $415, it fell down. This level is becoming a tough nut to crack for the crypto-currency. Going forward, in order for it to rally, it must cross $415 on a closing basis. However, there is strong support in the $315 to $320 region.

Actionable Insight

Short the BTC/USD below $375 for target of $368, $360, with a stop-loss of $379.5.

Leave A Comment