There have been no shortage of attempts to compare the meteoric rise of Bitcoin (and cryptocurrencies more generally) to the dot-com boom/bust.

Critics of the crypto craze will tell you that what we’re seeing in the space mirrors the euphoria that ultimately ended in tears in 2000. Proponents will argue that betting against Bitcoin is akin to betting against the internet – i.e. that the potential for widespread adoption is unlimited and no price is too high.

As a quick aside: here are a few bullet points from a Tuesday panel discussion with Glenn Hutchins and Mike Novogratz (whose new “target” is $40,000):

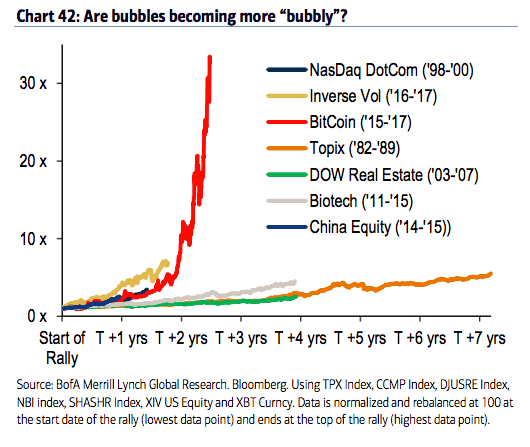

We have of course spilled gallons upon gallons of digital ink in these pages debating this and you can peruse our entire archive here. But suffice to say that while there are certainly good arguments for how/why the technology will ultimately be a game changer, there is an equally long list of arguments to support the contention that we long-since entered the realm of pure, unadulterated speculation. This chart underscores the latter point:

Below, find a nuanced take on this issue from DK, who pens some pretty interesting missives on the crypto space.

Leave A Comment