BlackBerry (BBRY) is set to announce quarterly earnings on Friday. Analysts expect revenue of $489 million and a loss of $0.14 per share. The revenue estimate implies flat growth sequentially. This may be a tall order as the company experienced a 26% sequential decline in revenue last quarter. Here is my take on what investors should focus on:

Priv Will Provide The Sizzle …

The company has made major headlines with its recent launch of the Priv – BlackBerry’s first Android-operated device. With its physical keyboard, security features and access to Google/Alphabet (GOOG, GOOGL) apps, the Priv has won rave reviews. The fact that the phone is getting more carrier support than prior BlackBerry devices also should help spur sales.

The Priv also has received some great PR, having reportedly sold out at select online retailers like Wal-Mart (WMT). I expected nothing less. In the past the company has channeled Nike’s (NKE) Air Jordan brand by limiting initial supplies in order to create frenzied demand.

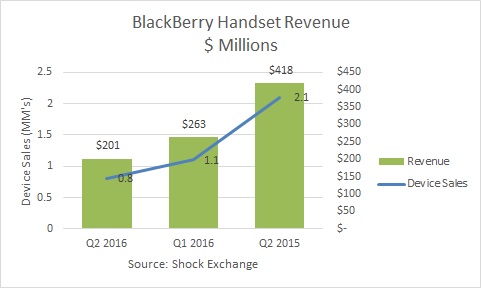

CEO John Chen estimates that BlackBerry could possibly break even at sales of five million handsets per year, or 1.25 million per quarter. The company sold 800,000 handsets in FQ2, down from 1.1 million the previous quarter.

After factoring in the potential cannibalization of sales from traditional BBRY devices by the Priv, I do not envision BlackBerry coming close to 1.25 million handset sales. However, initial Priv sales should provide enough “sizzle” to keep longs engaged for at least for another quarter.

… While Software Pays The Bills

Last quarter I was extremely disappointed by the performance of the company’s software/services segment. Software/services revenue fell 47% sequentially and appeared to fall off track on meeting Chen’s $500 million annual revenue bogey. Hopefully the company’s acquisition of Good Technology will change the revenue trajectory and sentiment.

Good offers BlackBerry the capability of incorporating its technology into clients’ secured operating systems, including Samsung’s (SSNLF). Though BlackBerry is the acknowledged leader in security for the enterprise, Apple (AAPL) and Microsoft’s (MSFT) ability to incorporate their EMM offering directly into their operating systems gave them a leg up in terms of ease of use. The Good deal potentially removes that advantage.

Leave A Comment