The last time the US Treasury had a solid 2Y auction the paper was trading very special in repo, suggesting a major short squeeze was inevitable, and that is precisely what happened. However, there was no explanation why today’s just concluded sale of $26 billion in 2 year paper was as blisteringly hot as it was: it certainly wasn’t the repo market, as the paper was trading comfortably north of the Y-axis all day, suggesting there was no forced squeeze into the auction.

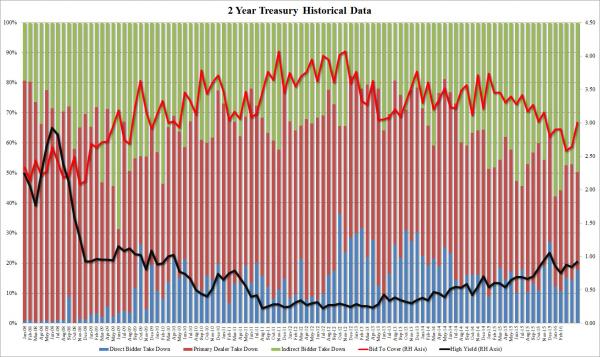

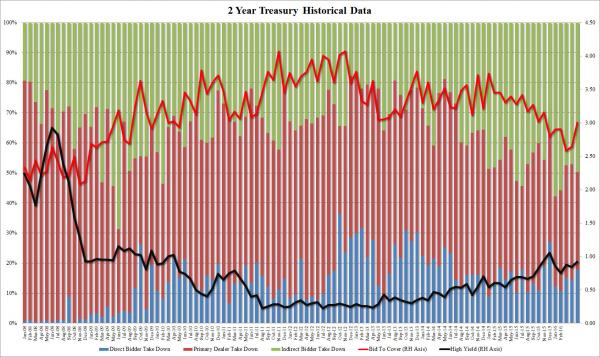

First, the high yield printed at just 0.92%, over 2 bps through the 0.943% When Issued. Indicatively, this was just shy of the 0.948% Yield that the 2Y printed at in November, one month before the Fed hiked rates.

Adding to today’s unexpected strength was the jump in the Bid to Cover which rose from 2.64 to over 3.00, the highest since November. The internals were likewise solid, with Indirects taking down a fraction under 50%, at 49.8%, and the highest since February’s 55.8%. Directs took down 17.7% of the auction, the most since December, leaving Dealers with just 32.5%, the lowest since January.

But the biggest surprise is that just weeks ahead of a potential Fed rate hike when the Fed’s tightening is supposed to force investors out of the short end, there was such surprising demand for 2Y paper.

Perhaps not everyone is buying the Fed’s latest flip-flop on hiking rates: traders of the short end certainly weren’t.

Leave A Comment