from the Chicago Fed

— this post authored by Rebecca Lewis , John W. McPartland , Rajeev Ranjan

Blockchain technology is likely to be a key source of future financial market innovation. It allows for the creation of immutable records of transactions accessible by all participants in a network. A blockchain database is made up of a number of blocks “chained” together through a reference in each block to the previous block. Each block records one or more transactions, which are essentially changes in the listed owner of assets.

New blocks are added to the existing chain through a consensus mechanism in which members of the blockchain network confirm transactions as valid. The technology allows the creation of a network that is “fully peer to peer, with no trusted third party,” such as a government agency or financial institution. [1]

While all are in the early stages of development, there are many promising applications of blockchain technology in financial markets. The bitcoin ecosystem represents the largest implementation of blockchain technology to date.[2] Interest in the technology continues to grow in the financial technology and broader financial services communities. In this article, we provide a brief overview of what blockchain technology is, how it works, and some potential applications and challenges.

What is a blockchain database?

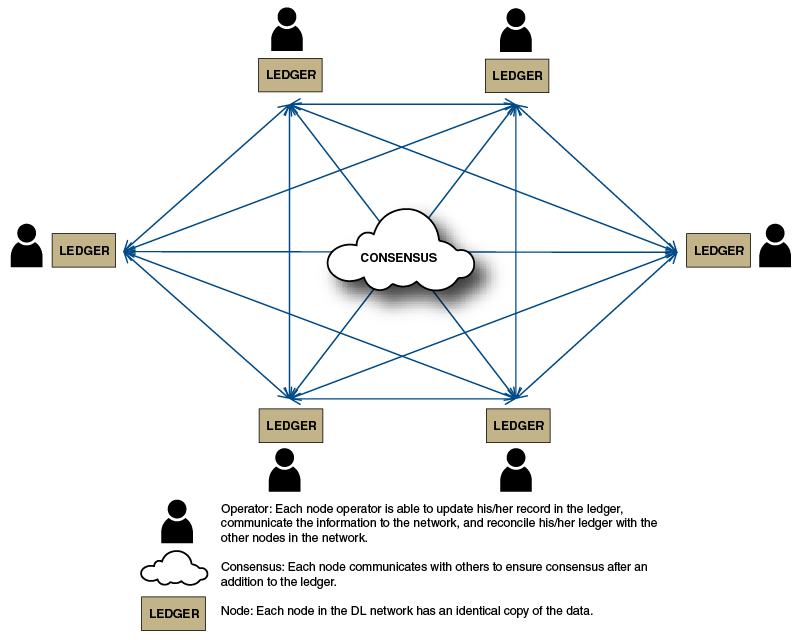

A blockchain database has a network of users, each of which stores its own copy of the data, giving rise to another term for blockchain technology: distributed ledger technology (DLT). Basic elements of a DLT network are: a digital ledger, a consensus mechanism used to confirm transactions, and a network of node operators (see figure 1 for the network setup). Generally speaking, the terms DLT and blockchain are used interchangeably in position papers and popular media, though DLT is considered by some to be a more general term.

Figure 1. Distributed ledger (DL) – Setup

Source: Financial Markets Group, Federal Reserve Bank of Chicago.

As one industry participant involved in developing blockchain technology described it, blockchain technology is essentially a new approach to database architecture. “Fundamentally, [it is] an improvement over the way that, traditionally, databases have been designed and used in the past.”[3] A traditional database is a large collection of data organized for rapid search and retrieval. While there are various ways of organizing data, traditionally, the vast majority of databases have been relational, storing data in tables that users can update and search.[4] Relational databases are centralized, with a master copy controlled by a central authority. Users sharing a database must trust the central authority to keep the records accurate and maintain the technological infrastructure necessary to prevent data loss from equipment failure or cyberattacks. This central authority represents a single point of failure; if the central authority fails, the database is lost. Users who do not trust one another must maintain separate databases that they periodically reconcile.

How does blockchain technology work?

The key elements of a blockchain-based ledger, those that will enable future efficiency gains, are the distributed nature of the ledger, its immutable character, and the existence of an agreed-upon consensus mechanism. These make it possible to automate transactions, providing for close to real-time settlement, while maintaining strong controls against fraud. These benefits do not depend on the exact technical implementation of any given blockchain – implementations will continue to be worked out in the coming years. However, a high-level overview of how a blockchain works helps to inform discussions about potential applications of blockchain and challenges that may arise.

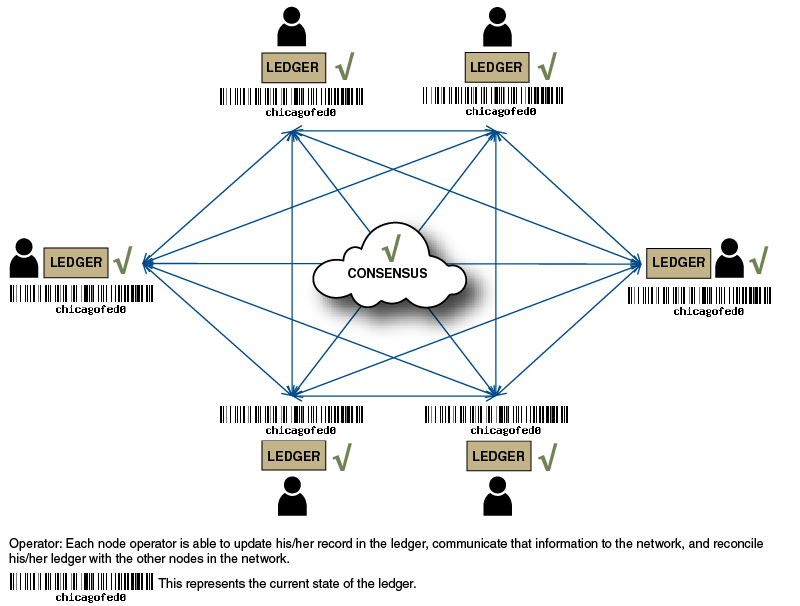

Figure 2. Distributed ledger (DL) network – All records are updated

Source: Financial Markets Group, Federal Reserve Bank of Chicago.

A simple distributed ledger

In its simplest form, each user can read from and write to the database; and each user’s copy is updated to reflect the new state of the ledger after a transaction is confirmed through a previously agreed-upon consensus mechanism (see figure 2). Once a transaction is added, it cannot be updated or deleted.

In the example in figure 2, all the node operators have the same version of the ledger (“chicagofed0″). Since all the versions of the ledgers are the same, consensus is achieved and the records are final.

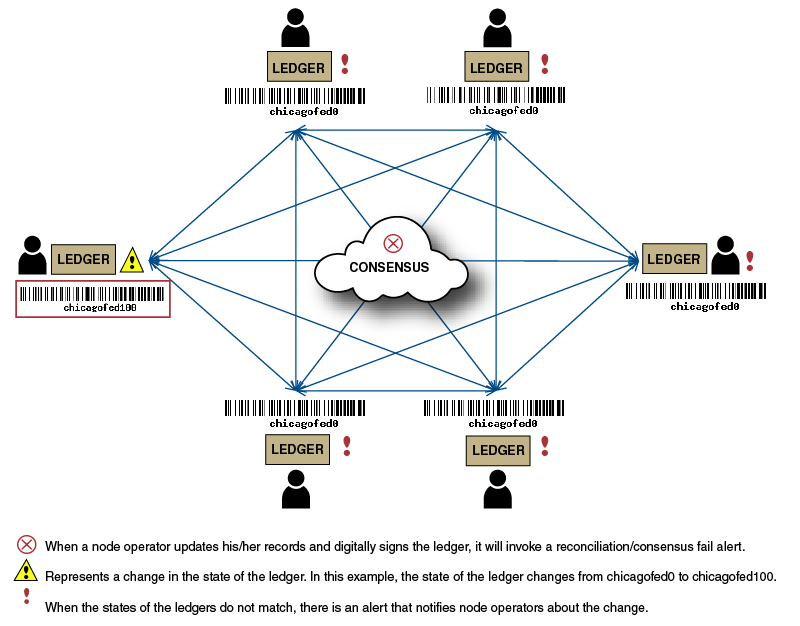

When a member of a blockchain network engages in a transaction, they submit the transaction to the network (see figure 3). The submission of the new transaction changes the state of the ledger (here to “chicagofed100″), which is now in conflict with the state of other copies of the ledger. Once the new transaction is discovered by the network, the consensus breaks, forcing other operators to either validate and update their records with the latest change or reject the new addition to the ledger.

Figure 3. Distributed ledger (DL) network – New record added and state changes

Source: Financial Markets Group, Federal Reserve Bank of Chicago.

A consensus mechanism then confirms the submitted transaction as valid. There are various methods of achieving consensus on a blockchain, as we discuss below. At this point, it is simply important to understand that a blockchain database must have a mechanism through which participants agree to a change in the state of the ledger. Once consensus is achieved, all ledgers are updated to reflect the new state (see figure 4).

How are transactions added to a blockchain?

At its most basic level, a transaction on a blockchain is simply a change in the registered owner of an asset. The process through which transactions are created and added to the blockchain is illustrated in figure 5.

For person A to transfer an asset to person B, it is first necessary to determine if A is the rightful owner of that asset. This can be done by referencing past transactions in the blockchain and finding that, at some point, A received the asset and has not yet sold it. Once this is done, A and B can agree to the transaction (step 1). A block is created with the details of the new contract (step 2), and then A and B agree to the contract by adding their unique digital signatures (steps 3 and 4). Once both parties have signed the transaction, a cryptographic hash is calculated that will be used to link this new transaction to the chain of previous transactions (step 5). The cryptographic hash is a string of characters associated with a given block that is difficult to calculate but easy to verify. This makes it simple to verify a legitimate block, but difficult to engineer and insert into the chain a block recording illegitimate transactions.

Leave A Comment