The canary in the coalmine of an increasingly desperate energy industry just croaked. With “unusual timing” and at “distressed prices,” Reuters reports that Phillips 66 (PSX) – the major US refiner owned by Warren Buffett – dumped crude oil for immediate delivery into Cushing storage. This sparked heavy selling of the front-month WTI contract (to a $26 handle) and crashed the 1st-2nd month spread to 5 year lows.

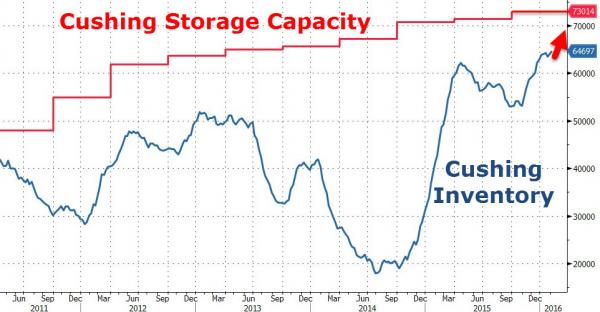

It was just last week when we said that Cushing may be about to overflow in the face of an acute crude oil supply glut.

And now with Reuters reportson major US refiners dumping crude, sparking speculation that the move reflected advance warning of looming output cuts amid sluggish winter demand and record inventories…

If Phillips 66 does cut refinery runs, it would be the third refiner to capitulate amid record gasoline inventories and negative margins.

Earlier on Wednesday, sources said Delta Air Lines’ Monroe Energy refinery near Philadelphia had decided to cut output by 10 percent at its 185,000 barrels per day (bpd) refinery due to economic reasons.

On Tuesday, sources said that Valero Energy Corp was planning to cut gasoline production at its 180,000 bpd Memphis, Tennessee, refinery by about 25 percent.

U.S. Energy Information Administration data on Wednesday showed inventories at the Cushing, Oklahoma delivery hub hit a record 64.7 million barrels last week – just 8 million barrels shy of its theoretical limit –stoking concerns that tanks may overflow in coming weeks.

And so, with the news that Phillips 66 is dumping in apparent size, it appears, as we detailed previously,that BP’s warning that storage tanks will be completely full by the end of H1

“We are very bearish for the first half of the year,” Dudley said at the IP Week conference in London Wednesday. “In the second half, every tank and swimming pool in the world is going to fill and fundamentals are going to kick in,” he added. “The market will start balancing in the second half of this year.”

Leave A Comment