Nobody has done a better job at making “meal kits” an actual category in the grocery business. Blue Apron generated an astonishing $795M in revenue last year. That was up from $340M in 2015 and just $78M in 2014. They had to give away lots of meals to get there and they were still losing money in 2016 ($55M) but they could have easily been profitable last year if they wanted to be.

So what’s the rub? Future growth will be harder to come by. Blue Apron knows it which is why they have been adding categories like wine and kitchen wares to their offering. Besides old-fashioned churn it seems that remaining customers tend to spend less over time. Adding to these challenging dynamics is increasing competition – not so much from other meal kit companies like Sun Basket and HelloFresh but the big players. Think Stop & Shop/Peapod, Amazon Fresh and imagine a combination of Whole Foods and GrubHub offering a menu of meal kits that can be delivered the same day.

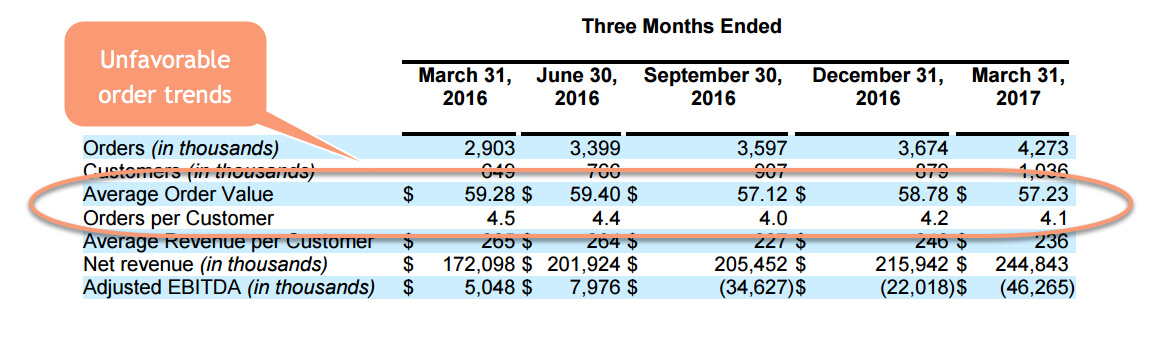

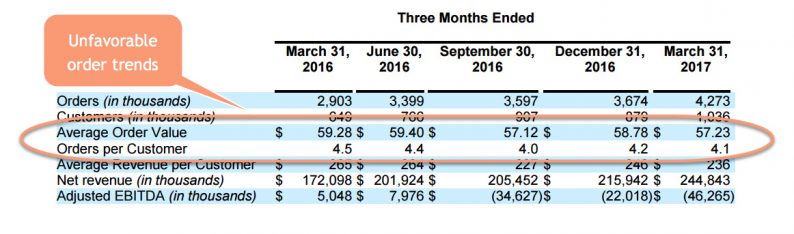

Order trends from customers

Unlike direct competitors, these larger players already have the infrastructure and supply chain which means they only need to add some packaging to create and sustain their own meal kit product lines. If Amazon introduced their own offering and promoted it the Blue Apron business would take a direct hit.

These are not mutually exclusive businesses. There will always be lots of niche businesses in an $800B (US) grocery market. But not many large and profitable ones.

So who is going to buy Blue Apron?

My favorite idea is another “cooking experience company, Williams-Sonoma (WSM). The reasons for a WSM deal are:

Leave A Comment