With falling oil prices, global tensions, and the Chinese slowdown, 2016 is clearly off to a rough start. However, BMO Capital Markets believes that turbulent times lend themselves to making long-term investments. Here, BMO highlights their top investment ideas for 2016 including Microsoft Corporation (Nasdaq:MSFT), Nokia Corporation (ADR) (NYSE:NOK), Skyworks Solutions Inc. (Nasdaq:SWKS).

Microsoft Corporation

Microsoft is among BMO’s top picks for 2016 as Keith Bachman believes the company can “leverage its solid portfolio of enterprise products, including Windows Server, SQL Server, Power BI and Dynamics to gain share in enterprise accounts.” Bachman currently has a Outperform rating on the company with a $64 price target.

Specifically, Bachman notes that Microsoft is gaining traction in its cloud segment, allowing the company to “gain incremental share of wallet across both on-premises and in the cloud enterprise solutions.” The analyst notes that Azure, Microsoft’s cloud platform, has the potential to grow 55% each year for the next three years, ultimately accounting for 5% of total revenue in 2018, up from 2% in the last reported quarter.

The analyst concludes, “Most importantly, we think Microsoft can grow operating income and FCF by 5%-7% y/y over the next few years… If we are right on our estimates for MSFT, we believe the stock can move higher, based on consistency, even if MSFT reports results that are largely in line with consensus estimates.”

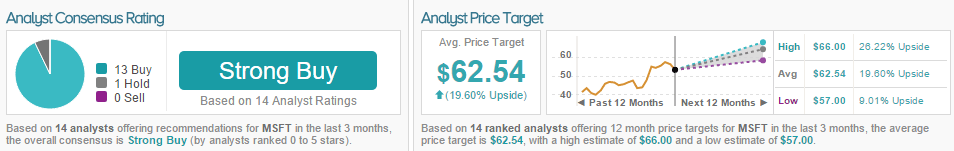

According to TipRanks, 13 analysts are bullish on Microsoft while 1 remains on the sidelines. The average 12-month price target for the stock is $62.54, marking a 19% potential upside from where shares last closed.

Nokia Corporation (ADR)

Tim Long is bullish on Nokia in 2016 thanks to its merger with Alcatel-Lucent. Last year, the companies announced that they would be joining forces, with Nokia offering $16.6 billion for the French telecommunications company. Long explains that the combined company adds “routing, optical, and a number of other wireline technologies” to Nokia’s arsenal, allowing it to “compete in bids for an end-to-end network provider.”

Leave A Comment