On Tuesday, Carl Icahn reiterated his feelings about the interplay between low interest rates, HY credit, and ETFs. The self-feeding dynamic that Icahn described earlier this year and outlined again today in a new video entitled “Danger Ahead” is something we’ve spent an extraordinary amount of time delineating over the last nine or so months. Icahn sums it up with this image:

The idea of course is that low rates have i) sent investors on a never-ending hunt for yield, and ii) encouraged corporate management teams to take advantage of the market’s insatiable appetite for new issuance on the way to plowing the proceeds from debt sales into EPS-inflating buybacks. The proliferation of ETFs has effectively supercharged this by channeling more and more retail money into corners of the bond market where it might normally have never gone.

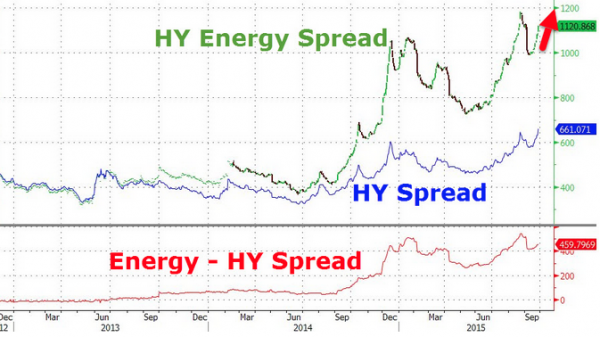

Of course this all comes at the expense of corporate balance sheets and because wide open capital markets have helped otherwise insolvent companies (such as US drillers) remain in business where they might normally have failed, what you have is a legion of heavily indebted HY zombie companies, lumbering around on the back of cheap credit, easy money, and naive equity investors who snap up secondaries.

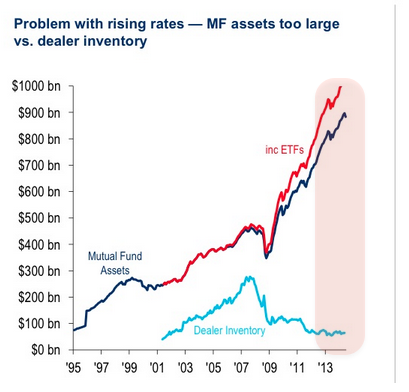

This is a veritable road to hell and it’s not clear that it’s paved with good intentions as Wall Street is no doubt acutely aware of the disaster scenario they’ve set up and indeed, they’re also acutely aware of the fact that when everyone wants out, the door to the proverbial crowded theatre will be far too small because after all, that door is represented by the Street’s own shrinking dealer inventories. Perhaps the best way to visualize all of this is to have a look at the following two charts:

So now that the wake up calls regarding everything described above have gone from whispers among sellsiders to public debates between Wall Street heavyweights to shouts channeled through homemade hedge fund warning videos, everyone is keen to have their say. For their part, BofAML is out with a new note describing HY as a “slow moving trainwreck that seems to be accelerating.” Below are some notable excerpts:

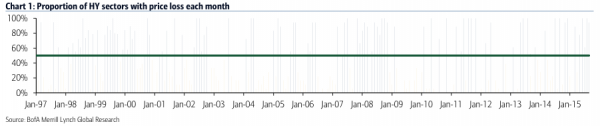

A slow moving train wreck that seems to be accelerating

For five months in a row now more than 50% of the sectors in our high yield index have had negative price returns. That’s the longest such streak since late 2008 (Chart 1). This isn’t to whip up predictions of utter doom and gloom as in that fateful year. But it’s a stark statistic, highlighting our principal refrain for the last several months – this isn’t just about one bad apple anymore. The weakness in high yield credit is to us not just a commodity story; it is about highly indebted borrowers struggling to grow, an investor base that cannot digest more risk, a market that has usually struggled with liquidity and an economy that refuses to rise above mediocrity.

The problems in the coal sector that began to surface two years ago were perhaps the canary in the coal mine in hindsight. It was easy to dismiss a tiny sector with badly managed companies in a product that was facing secular headwinds as a one-off. But then we had the collapse in oil prices, much more difficult to ignore given the sheer size of the Energy sector in high yield. Barely had the market got its head around the scale of the issue when metals and miners started showing tremors. Now it’s the entire commodity complex.

Leave A Comment