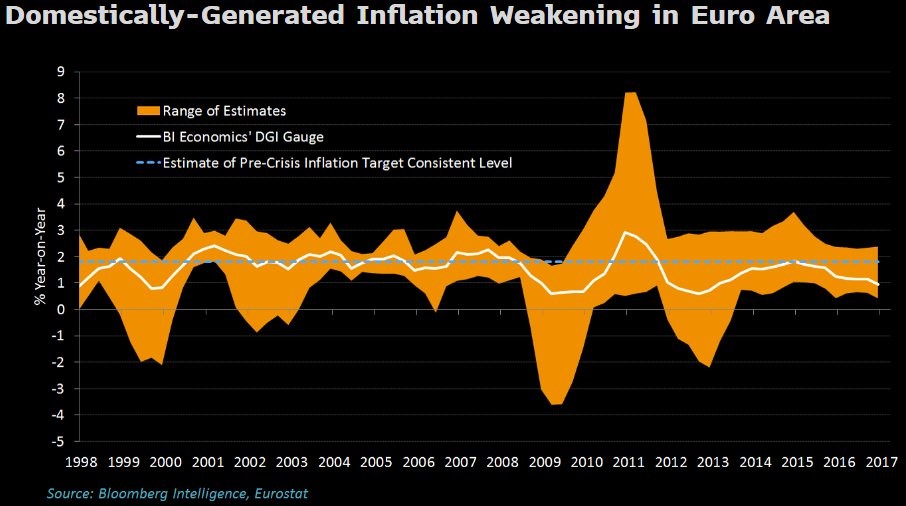

The Producer Price index increased 0.1% month over month, but on a year over year basis it fell from 2.4% in May to 2.0% in June. The decline was caused by the rise in oil prices dropping out of the metric. The core PPI was up 0.1% month over month and 1.9% year over year which is down from May’s 2.1% year over year increase. That’s below the Fed’s 2% inflation mandate, further adding to the number of inflation stats which show it below the mandate. The chart below is a unique measure of European inflation. Bloomberg argues domestically generated inflation is what matters. Regardless of whether it’s more important than regular measurements, it tells us where inflation is coming from.

As you can see, inflation is declining like in America and most estimates are below 2%. I don’t see why Europe has a 2% inflation target because one of the reason’s the Fed has it is because it can’t go to negative rates. The ECB is currently at negative rates, so that ship has sailed. Growth comes from productivity, not inflation. I consider the decline in inflation to be bullish for the chances of increased QE. The problem is if the ECB acknowledges that its QE doesn’t cause inflation, it makes it tough to subsequently argue for more QE to boost inflation.

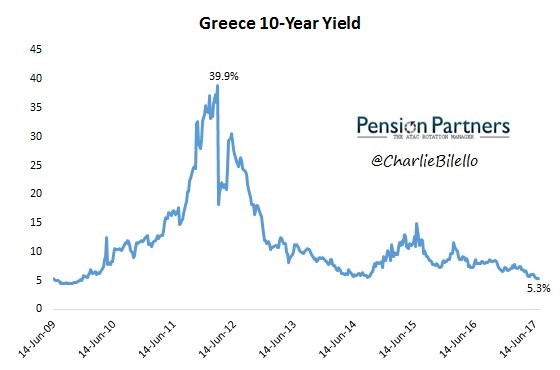

Along with the decline in inflation in Europe, the Greece 10-year bond yield is nearing pre-crisis levels. The ECB bond buying also has a hand in this. This chart is the ultimate depiction of the low yield environment and manipulation by central banks since the country’s debts are laughable. The debt to GDP in 2017 is 179% and it was 109.4% in 2008. Clearly the debts have no relation to the yields which only make sense in an interventionist low inflation environment. The manipulation of Greece’s yields are an indirect way to bailout the country as there’s no way it can stand on its own.

As you can see from the chart below, there has been a change in the normal relationship between inflation and the global high yield spread. Usually when the economy crashes, inflation falls and spreads rise. When the economy grows, inflation increases and spreads fall. Now inflation is falling, but spreads remain tight. That’s the ideal situation as it implies growth without price pressures. Unfortunately, reality isn’t that nice as the high yield spreads are less of an indicator of the economy now that the central banks have gotten more involved in the markets. Investors are in a risk on mode as the VIX fell below 10 today, but I wouldn’t use that to conclude the economy is very strong. It’s continuing its about 2% growth rate which is even lower on a per capita basis as the population grew 0.693% in 2016. In Q1 2017, real GDP per capital only grew 1.4%.

Leave A Comment