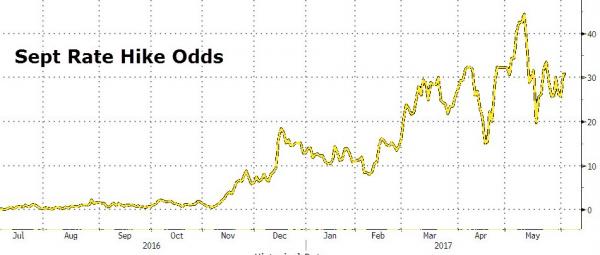

The market’s reaction to the dismal jobs data was uniform in its disappointment – while June rate-hike odds remain near 100%, September dipped a little (at just 30%), the dollar dropped, stocks fell, and bond yields tumbled.

‘Hard’ data is collapsing again to 13 month lows as soft data catches down.

And September rate hike odds are stuck around 30%.

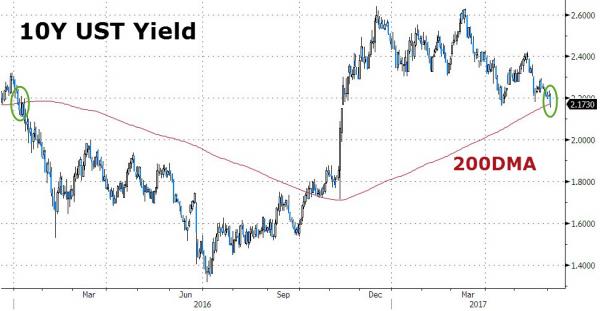

10Y Yields tumbled to 2.15 intraday – the lowest level since November 10th 2016… and broke below the key 200-day moving average.

The Dollar Index tumbled, testing the 2017 lows.

Gold jumped to 6-week highs, bouncing off its 50dma.

And stocks double-dipped back into the red.

Leave A Comment