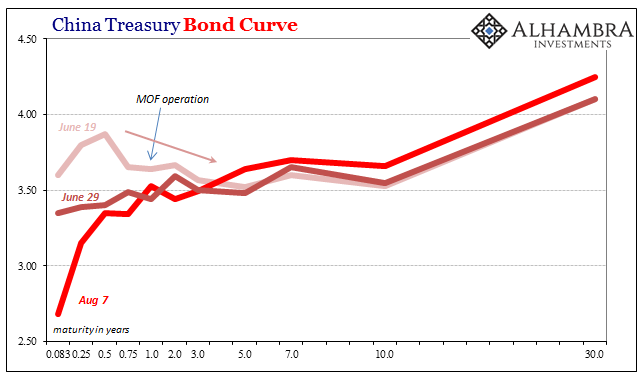

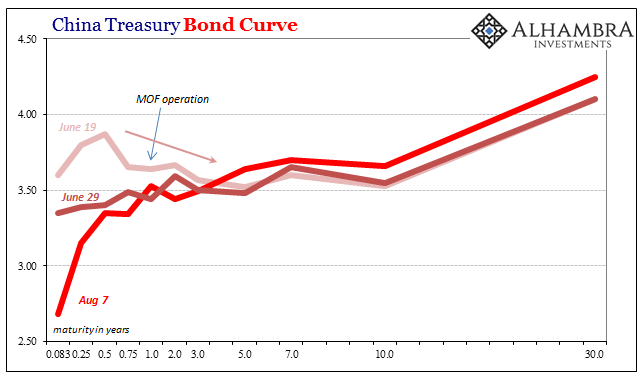

Back in June, China’s federal bond yield curve inverted. Ahead of mid-year bank checks, short-term govvies sold off as longer bonds continued to be bought. It was for some a rotation, for others a reflection of money rates threatening to spiral out of control. On June 19, for example, the 6-month federal security yielded 3.87% compared to a yield of 3.525% for the 10-year.

Several liquidity operations as well as symbolic intervention by the Ministry of Finance (at the 1s) eventually wrested control of the yield curve. By July, China’s government curve, which has never really been textbook pretty, was back to a more normal shape. Money rates were behaving again and more so CNY’s ascent continued undaunted (projecting confidence).

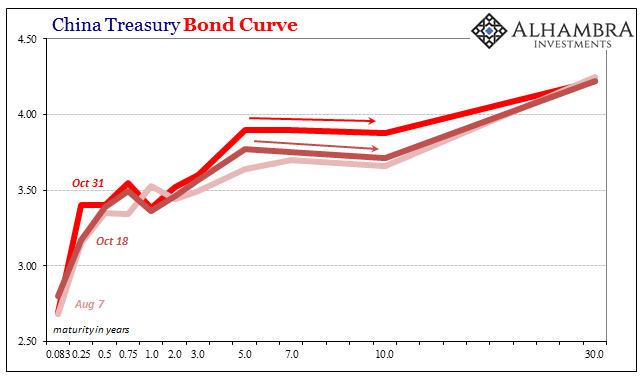

As those took shape, China’s bond market sold off in general. Government bond yields have been rising across the curve but mostly in the all-important middle. The 5-year rate that had been 3.48% as late as June 29 was 3.90% yesterday. The 10s that were 3.55% then are 3.88% now. Thus, China’s government bond curve is inverted again, but this time where it really counts.

As is usual in these circumstances, but especially with regard to anything China, the mainstream West is quick to re-assure.

China’s bond market has just turned upside down again. But unlike in the U.S. — where an inverted yield curve can signal an impending recession — there’s much less reason for President Xi Jinping to worry.

That’s because the anomaly is pretty much government-driven, with the central bank driving short-term rates higher to tamp down excessive leverage. Policy makers have stepped in on occasion to prevent excessive tightness, through cash injections or targeted easing. Yields also have climbed this week because of signs of an improving economy, with People’s Bank of China Governor Zhou Xiaochuan suggesting that growth may surprise to the upside. [emphasis added]

Leave A Comment