“Just one more wafer-thin mint of monetary-easing?”

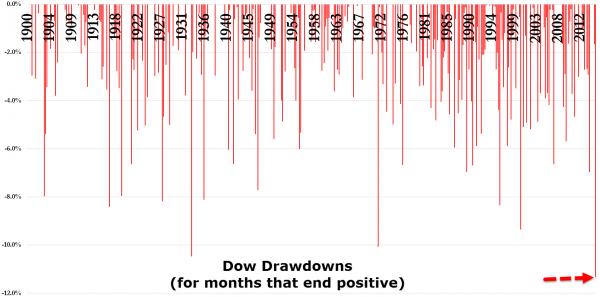

Before we start, a reminder…

This was the greatest quarterly comeback in the history of stocks…

Because fundamentals…

So with that said, stocks remain the big winner post-Yellen as all the gains for bonds, bullion, and black gold are erased…

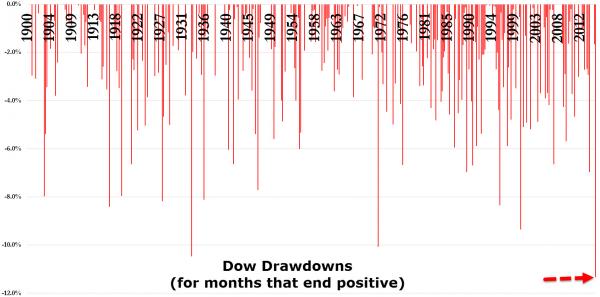

Because all that matters is a green close for the quarter…

But this looks familiar…

Small Caps are the biggest (Short-Squeeze) winners post-Yellen…

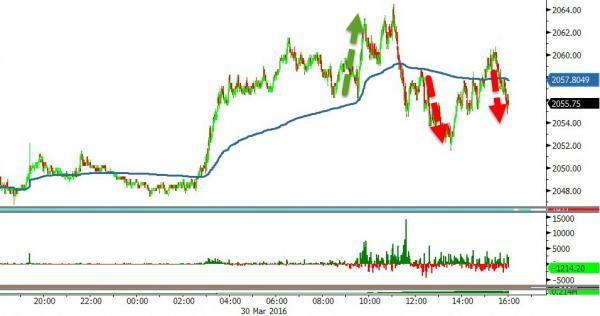

S&P Futs saw VWAP buying orders at the open but selling pressure built…

As VIX was crushed…extending its drop post-Yellen…

To its lowest close since August 17th 2015 (right before the China collapse)…

30Y bond yields recoupled with stocks post-Yellen BUT FX Carry remains notably untied…

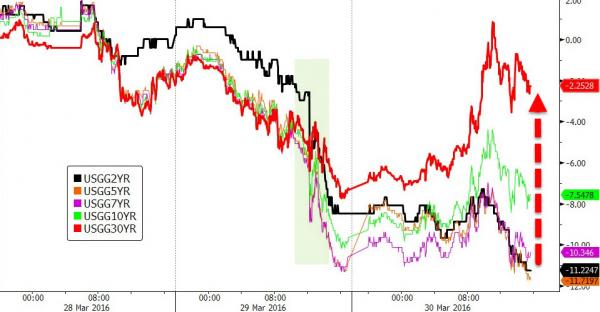

Treasury yields were very mixed with a major underpeformance at the long-end (2Y -3bps, 30Y +5bps) – biggest 2-day steepening of 2s30s in 4 months

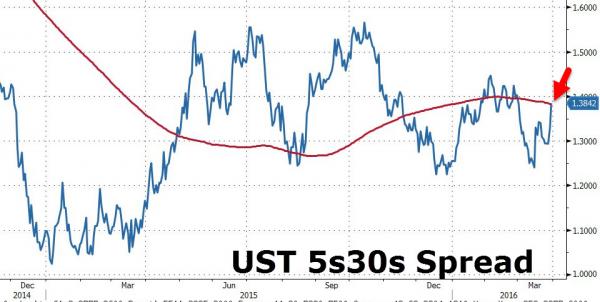

5s30s spiked to its 200-day moving average…

The USDollar Index dropped for the 3rd day in a row, back near 5-month lows…

Despite US Dollar weakness, commodities all ended lower on the day (with gold and silver clinging to gains on the week)…

One look at the crude price action and you know that NOTHING matters aside from the algos… This is crude’s 6th losing day in a row – the longest losing streak since mid-January

And finally, Oil Vol is now at an extreme relative to Equity Vol – which has recently indicated trouble ahead for stocks…

Charts: Bloomberg

Bonus Chart: The Fed shows that it’s hard to understand anything when your job depends on ignoring it…

*EVANS SAYS IT’S HARD TO IDENTIFY ASSET PRICE BUBBLES (yeah, right!) pic.twitter.com/bQCMbdNmef

— Tim Backshall (@credittrader) March 30, 2016

Leave A Comment