By Steven Levine

Soft drink icon Coca-Cola (KO) has agreed to purchase British multinational coffeehouse Costa for £3.9bn (US$5.1bn) to capitalize on growing its hot beverage category in overseas markets.

Through the deal, KO will acquire the international coffee platform from UK-based multinational Whitbread (WTB), including nearly 4,000 retail outlets that extend across parts of Europe, Asia Pacific, the Middle East and Africa, with the opportunity for additional expansion.

KO, owner of brands that include Dasani waters, Fanta, Sprite and Minute Maid juices, has been generally transitioning away from its sugar-laden offerings, amid changing consumer spending patterns. By purchasing Costa Coffee, KO will also significantly increase its global share of the coffee category from its position with Georgia in Japan.

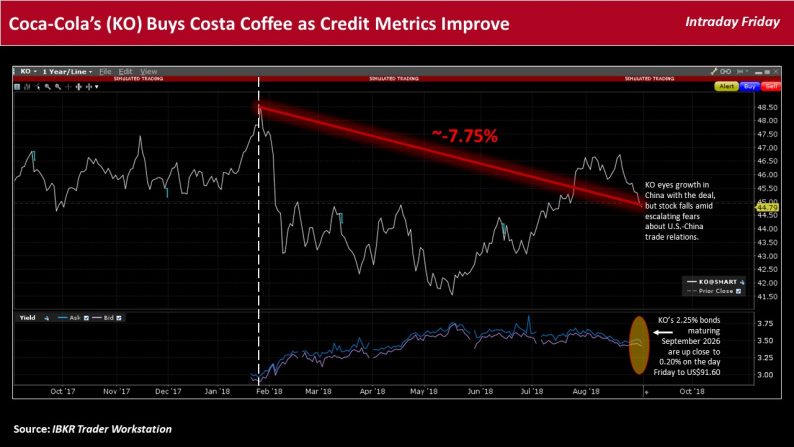

[KO’s 2026 bond added below its stock using TWS charting tools.]

KO CEO James Quincey said the hot beverage category is “one of the few segments of the total beverage landscape where Coca-Cola does not have a global brand,” and that Costa enables access to that market with a strong coffee platform – including a supply chain, roaster, retail presence and vending system.

Quincy added that by acquiring Costa, “Coca-Cola will add a retail footprint in parts of the world,” with the Costa brand offering KO the potential to expand into global ready-to-drink coffee markets, including gas stations, movie theaters and travel hubs.

KO’s aim to increase its global footprint in the coffee category appears to be aligned with a general trend among consumer staples companies who are eying merger-related growth.

Analysts at Deloitte, for example, highlighted that companies in the consumer products industry will “strive to strategically capitalize on growth in emerging markets, and seek opportunities to acquire or partner with companies to enable access to consumers, leverage market solutions, and in some cases, access sources of raw material.”

Leave A Comment