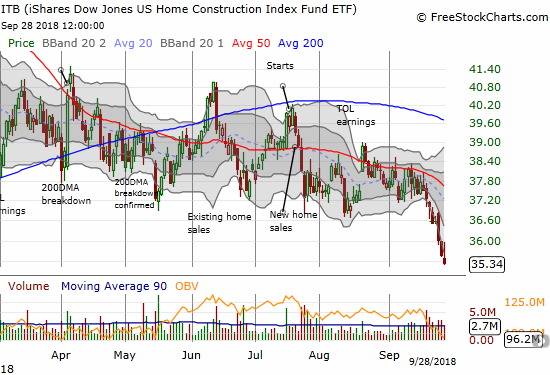

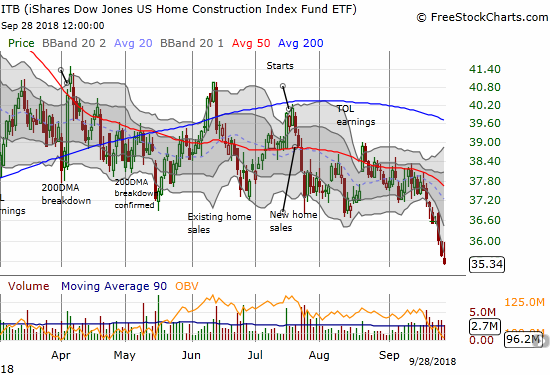

The S&P 500 (SPY) printed its best quarter since the fourth quarter of 2013. While the index gained 7.2% for the third quarter of 2018, home builders went in the exact opposite direction. The iShares US Home Construction ETF (ITB) tumbled 7.4% for Q3 and is now down a whopping 20.9% year-to-date. The selling accelerated in ITB in the closing week of the quarter as ITB broke down to a new low for 2018 and then a 52-week low.

The iShares US Home Construction ETF experienced a very bearish breakdown to close out the third quarter of 2018.

This kind of trading action is definitively bearish. The negative sentiment directed toward home builders is highlighted by the extremely low valuations of most of the stocks in the sector. A large number of these builders are now trading at book value or LESS. These kind of depths typically happen during economic downturns so the contrast with the rest of the economy is very stark. “Something” presumably has to give at some point: either home builders are screaming buys or home builders are screaming imminent recession.

Here are home builders which hit or crossed the 1.0 book value threshold (all valuations from Yahoo Finance).

Century Communities (CCS)

Price/Book: 0.98

Trailing P/E: 9.4, Forward P/E: 5.3, Price/Sales: 0.43

I bought shares of CCS at the end of June as an exception to my growing wariness about the housing market and home builder stocks. At the time, CCS looked like it would hold support at its 50-day moving average (DMA) and remain a strong house in a deteriorating neighborhood.

Century Communities broke down to a new low for the year after JP Morgan downgraded the stock to a neutral. The stock closed the week near a 52-week low.

Five Point Holdings (FPH)

Price/Book: 1.04

Trailing P/E: 106.9, Forward P/E: 44.8, Price/Sales: 22.2

FPH has suddenly become my longest standing holding in the sector. While I slowly shed other positions, I stuck by newly issued FPH as a play on the strong performance in California’s housing market. The stock never gained any real traction and has spent a lot of time selling off. I held onto FPH assuming that the stock was just “misunderstood.” Instead, it was ME who misunderstood! At this point, I am just going to keep this position as a base holding through whatever cycle is underway for housing. Note that FPH’s high valuation beyond book value suggests the stock could go down a lot further if market sentiment stays negative.

Leave A Comment