There are several instances in which European stocks have significantly higher dividend yields than their U.S. based counterparts. One example is in the health care sector, where GlaxoSmithKline (GSK) has a 5% dividend yield.

Big Oil is another example. U.K.-based BP (BP) has a 6.7% current dividend yield. Along with Royal Dutch Shell (RDS-B), these two European oil stocks have significantly higher dividend yields than U.S.-based oil stocks.

Of course, there is a trade-off, which is that BP has not raised its dividend regularly, as many U.S. energy companies have. The 2 most dominant U.S. Energy stocks are both on the Dividend Aristocrats List – a group of 50 stocks with 25+ consecutive years of dividend increases:

For comparison, BP suspended its dividend in 2010 after the Gulf of Mexico oil spill. It then resumed its dividend at half the previous level in 2011.

This article will assess BP’s current business conditions and the measures it is employing to support its high dividend yield.

Business Overview

BP is a global oil and gas producer. It operates as an “integrated” company, meaning it has an upstream and downstream segment. Upstream activities include exploration and production of oil and gas. Downstream includes refining.

The best aspect of operating an integrated model is that it provides balance to the organization. That is because refining profits tend to rise when oil prices decline.

With oil prices down by roughly half since their 2014 peak levels, exploration and production activities have taken a severe hit. BP lost $6.5 billion last year. The results would have been much worse, if not for its diversified business model.

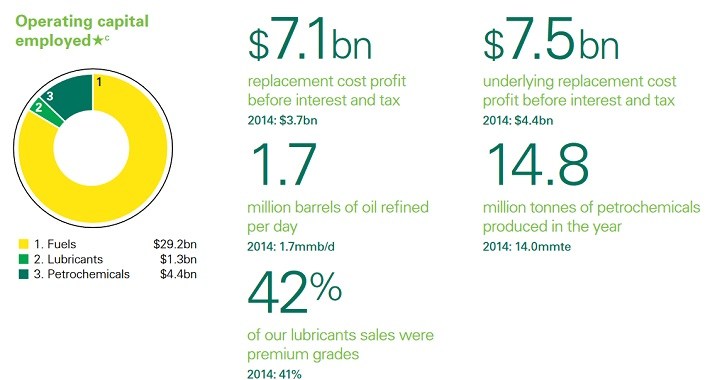

In 2015, BP earned $7.5 billion in downstream profits. BP has a large refining unit.

Source: 2015 Annual Report, page 7

Downstream profits last year set a record, and helped offset a significant loss on the upstream side of the business.

Leave A Comment