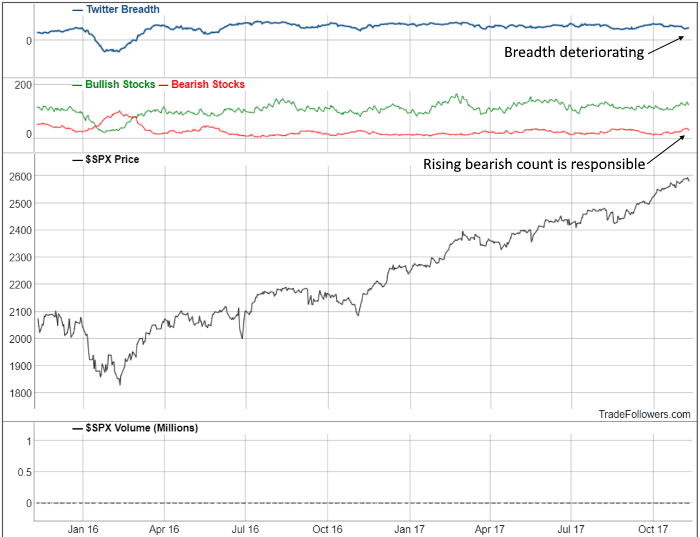

Breadth calculated between the most bullish and bearish stocks on Twitter is declining. The culprit is the count of bearish stocks. It’s slowly creeping up even as the market rallies.

Sentiment for the S&P 500 Index (SPX) is bouncing between extreme optimism and neutral. The behavior is similar to the rally from November 2016 to late February 2017, although the current period is much more optimistic. We’ll just have to wait and see how long it lasts.

Support and resistance levels gleaned from Twitter for SPX show solid resistance at 2600. Minor support comes in at 2550 and 2500. Notice the recent weakness brought out new calls for 2550 on SPX. It only took a bit of fear to recreate the price range.

Conclusion

The market keeps working its way higher, but the bearish count is rising. Overall sentiment for SPX is very optimistic, but has been in a fairly solid range between 2550 and 2600 on SPX. With so many conflicting data points we’re in wait and see mode.

Leave A Comment