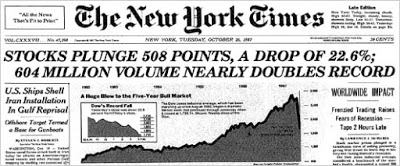

The 30th anniversary of the 1987 equity market crash the major US benchmarks at record highs. The drop in the market was at least partly a function of the lack of capacity, sufficient instruments, and regulatory regime. Each of these factors has been addressed to some extent. Circuit breakers have been introduced, and have evolved. The financial capacity has grown immensely. Sophisticated portfolio insurance, better hedging techniques, and tools are available. This most assuredly does not mean that equities cannot crash.Surely they can.How it does it, though can change.

Meanwhile what concerns many investors now is not the market structure as much as valuation. In 1987, the bull market was five years old. The current bull market is eight years old and counting. Many investment managers have expressed concern about the stretched valuations, though the year-over-year growth in earnings is roughly matching the S&P 500 advance this year. At the same time, with the ECB and the BOJ buying up practically all new net issuance of sovereign bonds, and yields remaining low (with an estimated $3 trillion in negative yielding bonds), many investors see little alternative to risk assets, including stocks.

Equities are trading heavier today. The MSCI Asia Pacific Index is off slightly but lowers for the third session, after the snapping an advancing streak that saw one down day from September 29-October 16. Japanese stocks advanced ahead of the weekend election in which the Abe’s Liberal Democrat Party may secure a larger majority than it has today. MOF data showed that foreign investors bought Japanese shares last week for the third consecutive week. Over the three weeks, foreigners purchased nearly JPY1.55 trillion of Japanese shares, the most in any three week period in two years, which itself was the most since at least 2001.

Chinese shares fell, with the Shanghai Composite off 0.35%. Chinese data failed to impress. Q3 GDP expanded by 6.8% year-over-year,in line with expectations. That is a 1.7% quarterly advance. It was supported by somewhat stronger retail sales (10.3% year-over-year) and industrial output (6.6% year-over-year). Fixed investments slowed (7.5% vs. 7.8%). China reportedly created 10.97 mln jobs in the first three quarters, well on its way of meeting its 11 mln target. Consumption, which includes some government spending is estimated to 64.5% of China’s GDP.

Leave A Comment