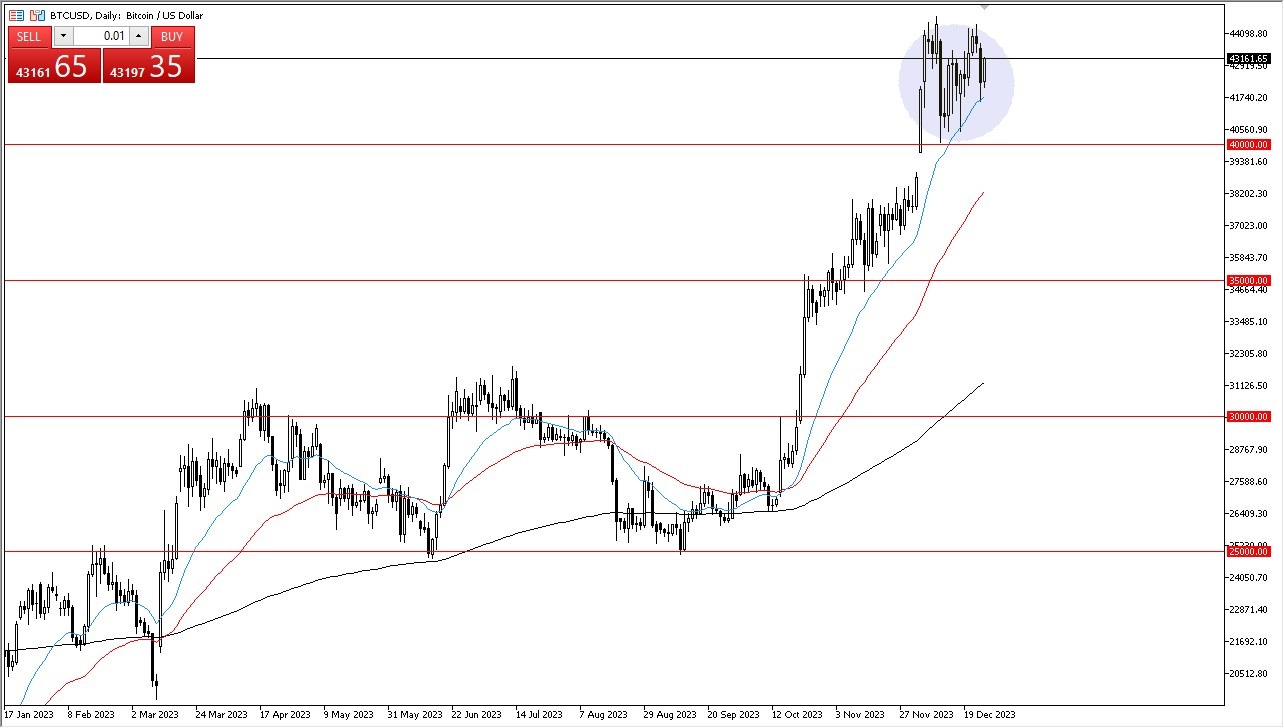

Ultimately, the Bitcoin market is exhibiting signs of stabilization and potential growth, backed by both technical supports and favorable fundamental factors.The Bitcoin market has witnessed a modest rally during Wednesday’s trading session, indicating a continuation of the prevalent volatile behavior. This recent movement underscores the underlying strength at the 20-Day Exponential Moving Average, offering a robust support level. The market’s oscillation suggests an ongoing struggle to gather sufficient momentum for a more significant move. Presently, the $40,000 mark is emerging as a critical support zone, reinforcing the 20-Day EMA. This convergence of support levels suggests that a period of consolidation is more likely than a retreat. The fundamental backdrop for Bitcoin is aligning favorably, enhancing its prospects. Fundamental Factors and Bitcoin’s Trajectory

The possibility of such an ETF is drawing institutional investors’ attention, underscoring the sustained interest in Bitcoin. This interest, coupled with the availability of “cheap money,” sets a promising stage for Bitcoin’s growth. While some market observers are optimistic about 2024 being a landmark year for cryptocurrencies, opinions vary. However, the potential for another significant surge in Bitcoin’s value is undeniable.The current market scenario favors a “buy on the dips” strategy. Even if Bitcoin’s value were to dip below the $40,000 threshold, the $38,000 level appears as another support, backed by the presence of the 50-Day EMA. This alignment of technical indicators fortifies the support structure. Barring any major shift towards a “risk-off scenario,” Bitcoin is well-positioned to continue its upward trajectory. Long-term chart analysis points to the $47,500 level as a primary target, having previously acted as a substantial resistance point. A breakthrough above this level could propel Bitcoin towards the $50,000 mark and potentially even higher, as it would signify a significant reduction in selling pressure.Ultimately, the Bitcoin market is exhibiting signs of stabilization and potential growth, backed by both technical support and favorable fundamental factors. The environment seems ripe for continued investment and interest in Bitcoin, with significant levels of support laying the groundwork for future rallies. As the market navigates through these dynamics, the potential for substantial gains remains a compelling aspect of Bitcoin’s ongoing journey.  More By This Author:Gold Forecast: With A Modest Rally On Tuesday ETH/USD Forecast: Buyers Step in to Lift Ethereum AgainSilver Forecast: Looks For Buyers On Dips

More By This Author:Gold Forecast: With A Modest Rally On Tuesday ETH/USD Forecast: Buyers Step in to Lift Ethereum AgainSilver Forecast: Looks For Buyers On Dips

Leave A Comment