There’s been no shortage of digital ink spilled in these pages about what central banks hath wrought in terms of the incentive for corporates to borrow to fund buybacks.

With policymakers driving everyone down the quality ladder in search of yield, investors clamor for corporate debt. And where there’s insatiable demand, there will be someone who’s more than happy to meet it with supply. Of course, the temptation is to use the proceeds from record issuance to fund share repurchases and that creates perverse incentives. Here’s how we described the situation last week:

The main worry here is that corporates have leveraged themselves to the hilt in an environment characterized by an insatiable hunt for yield among investors. In order to keep the ravenous hordes sated, corporate management teams have simply met demand with more supply and in many cases used the proceeds to buy back shares in a “virtuous” loop that not only inflates the bottom line, but also boosts management’s equity-linked compensation. See? Everyone’s a winner!

Well, everyone except the people who care about the balance sheet and the extent to which it’s being leveraged in pursuit of a myopic, greed-driven agenda.

So there’s that. And if you want to look at some scary corporate leverage charts, you can find them in the piece that’s excerpted from.

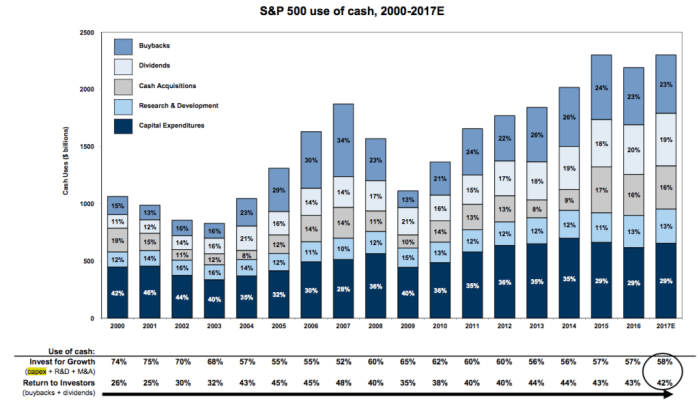

Of course, if you’re engaged in financial engineering, you’re by definition not spending on productive capacity and that has obvious implications for the economy. Have a look at the trend in this chart from Goldman:

You could argue that we don’t need any more capacity so why would you want to go out and help spend us all into a deflationary spiral, but that’s a kind of chicken-egg scenario. Because as Bloomberg’s Cameron Crise reminds you on Thursday, “investment creates jobs and economic growth.”

Read below as Crise explains that when you compare the S&P 500 dividend yield with net-of-tax corporate borrowing rates,” you find that “over the last couple of years it has never been as attractive to borrow to pay shareholders, using data since 1990.”

Leave A Comment