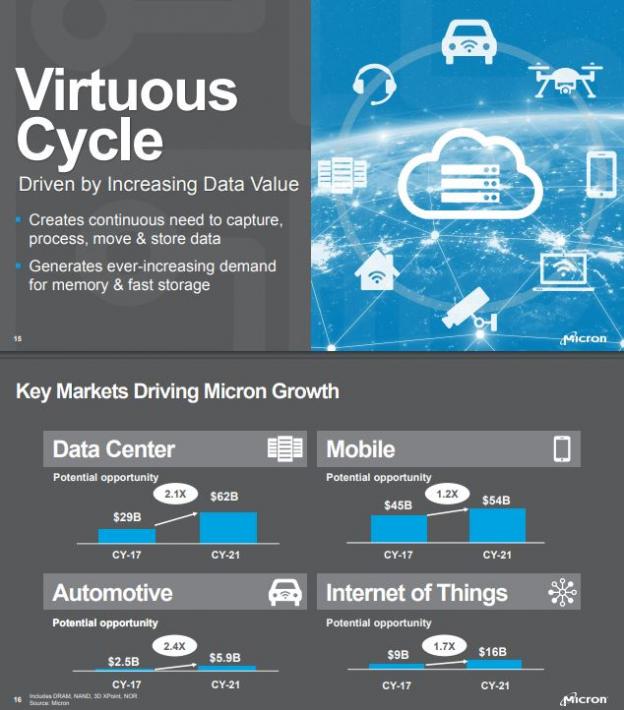

Micron (MU – Free Report) has been a Zacks #1 Rank since late May after the company’s Analyst & Investor Event when CEO Sanjay Mehrotra raised guidance for Q3 and unveiled their powerful growth plans in multiple markets, including datacenters, mobile, cars, and the IoT.

The maker of dynamic random access memory (DRAM), NAND flash memory, CMOS image sensors, and other semiconductor components sees a burgeoning data-hungry economy with memory-intensive applications driving secular growth across their markets.

But the stock has gone nowhere since May as some analysts and investors worry about the coming peak in the semiconductor cycle amid a potential glut of memory products.

And this despite EPS estimates rising again since their Q3 report (FY18 ends in August) on June 20. For fiscal year 2019 (beginning September), consensus profit projections rose from $10.75 to $11.30.

This makes Micron trade at under 5 times forward earnings estimates. Granted, memory chip makers tend to trade in a valuation range of only 5 to 9 times. But from the current market reaction, one might think the end of the cycle was indeed imminent.

A Big Look at the Big-Data Economy

There are also concerns about the impact of escalating trade battles between the US and China, with intellectual property disputes at the center as the world’s second-largest economy seeks to build its own technology empire by the year 2025.

But the world’s “data economy” as Micron calls it is inextricably intertwined and semiconductor manufacturing and testing happens across multiple borders before a product is finished. This is another reason that tariffs will be harmful to US companies.

More on the tariff tantrums in a moment. First, let’s look at what Micron sees for growth in their end markets over the coming years from two slides in the 150-slide deck that they dropped on Wall Street in May…

Unless a global recession is about to unfold, how can any technology investor not be involved in these trends? As I wrote for Zacks Confidential on Monday in my special report Artificial Intelligence: Investing in Life 3.0…

Leave A Comment