Let me update the discussion in last week’s missive “Bears Gain On Bulls:”

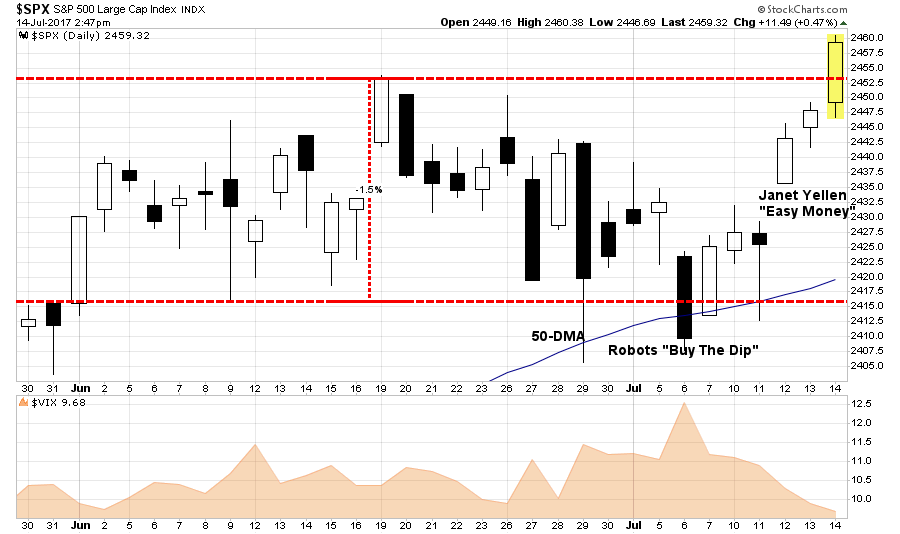

“The last couple of weeks have experienced a sharp rise in price volatility. While stocks have vacillated in a very tight 1.5% trading range since the beginning of June, there has been little forward progress to speak of. However, notice that support at 2415 (50-dma) has remained solid as ‘robots’ continue to execute their program of ‘buying the dips.’”

The chart below is updated through Friday afternoon:

With respect to portfolio positioning I also stated:

“This lack of progress keeps us ‘stuck’ with respect to portfolio positioning.”

However, this changed this past week as Yellen uttered the two magic words: “EASY MONEY.”

Okay, it wasn’t exactly two words. It was actually:

“Because the neutral rate is currently quite low by historical standards, the federal funds rate would not have to rise all that much further to get to a neutral policy stance.”

In other words, by saying that interest rates would not have to rise much further, the markets translated that to “lower interest rates for longer,” confirming the Federal Reserve will remain “highly accommodative” to the markets so, therefore, “buy stocks.”

And with that, the robots leaped into action pushing markets OUT of the month-and-a-half long trading range of just 1.5%. This push to new highs, as noted above, also triggered a short-term “buy signal,” at the bottom of the chart, which suggests this rally should continue higher over the next week, or so, heading into the month of August.

With the break above 2452 on Friday, assuming it will hold above that level into next week, it will provide an opportunity to increase short-term equity allocations in portfolios. However, be mindful, this is VERY short-term in nature and could be quickly reversed – so manage your risk accordingly.

As I noted last week:

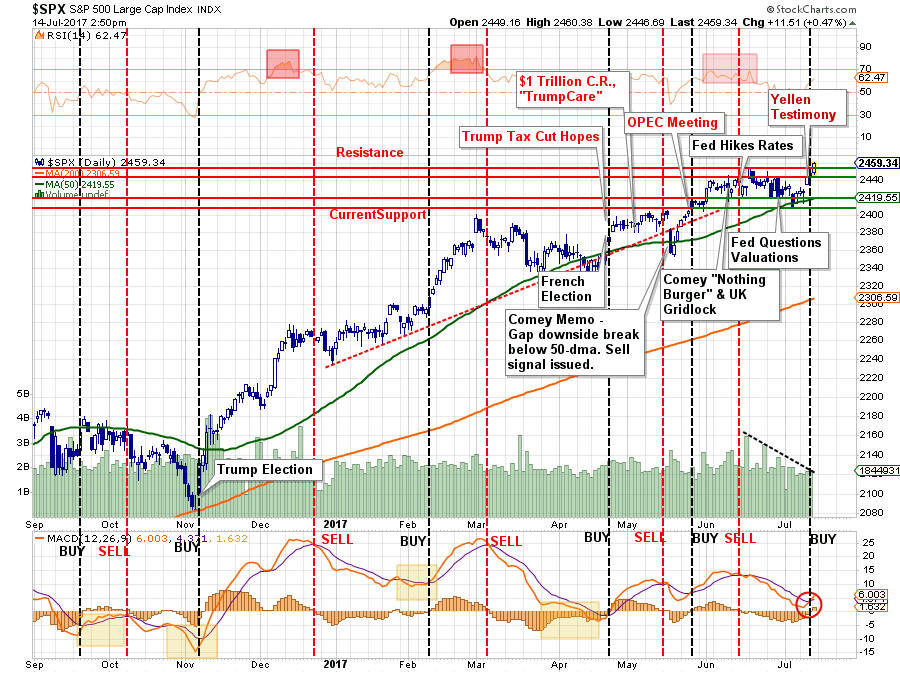

“I remain very cautious on the overall market, currently…However, the trend remains bullishly biased which keeps portfolios allocated on the long side for now.

With that said, the recent ‘sideways’ movement has NOT worked off the previous overbought condition of the market on an intermediate term basis as shown below.”

One note of caution, the advance this past week was NOT strong enough to reverse either“sell signal” currently. However, if the advance continues through next week, those signals will turn positive giving more short-term support to the bullish advance.

Next Stop 2500 or 3000?

Back on June 9th, I posited the idea of a new price target for the market of 2500. To wit:

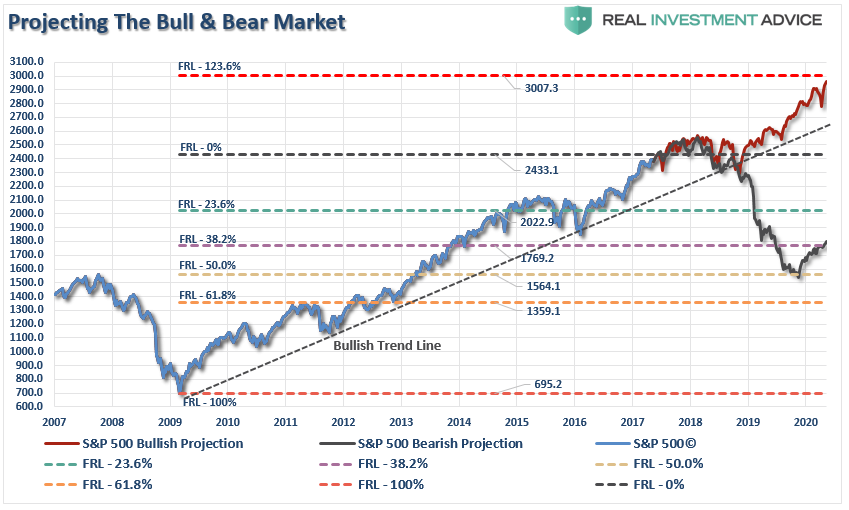

“Let me state this VERY clearly. The bullish bias is alive and well and a move to 2500 to 3000 on the S&P 500 is viable. All that will be needed is a push through of some piece of legislative agenda from the current administration which provides a positive surprise. However, without a sharp improvement in the underlying fundamental and economic backdrop soon, the risk of something going ‘wrong’ is rising markedly. The chart below shows the Fibonacci run to 3000 if ‘everything goes right.’”

Given that a major piece of legislative agenda has NOT been pushed through as of yet, there remains “hope,” combined with the support of Central Banks globally, which continues to support the acceptability of higher current valuation levels.

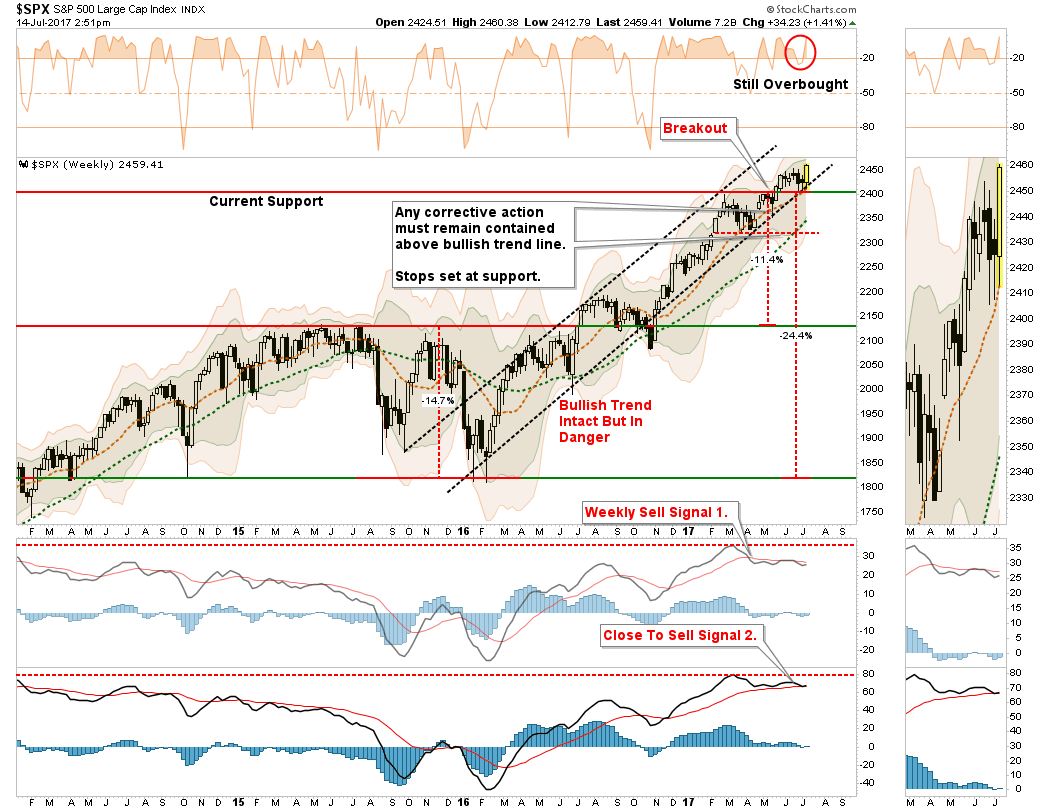

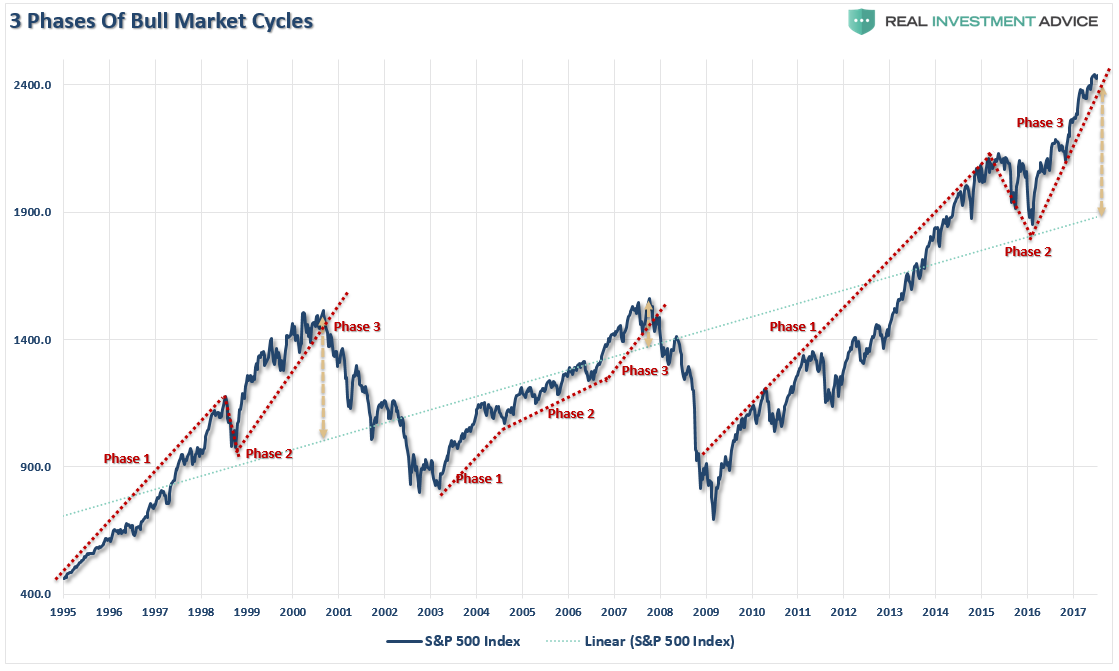

While the short-term outlook is bullish, the longer-term backdrop still remains highly risky. I have shown the chart previously of the 3-phases of a “bull market” advance. The current near “vertical acceleration” of the market has been indicative of previous “3rd-phase melt-ups” in the market.

Of course, such phases of “exuberance,” can last longer and rise further than logic would dictate. So, it is important to dismiss the duration, and extent, to which illogic can prevail.

Importantly, notice in the chart above the deviation from the long-term linear trend line of the market. Such deviations can NOT last forever. As such, it is always important to remember that ALL bull-runs are a one-way trip.

While our investment discipline requires us to take on additional exposure with this breakout, we maintain very tight stops and have a very disciplined process for handling risk. The risk YOU have to weigh is, from current levels, IF everything goes right there is roughly 600 points of upside. If something goes wrong there are 900 points of downside.

Leave A Comment