“Whatever it takes” has morphed to “throw everything at it and pray.” In a bigger-than-expected bazooka, Mario Draghi sent EUR/USD tumbling, Bund yields rising, and stock prices surging (along with considerable bond spread compression). Bank stocks are up in various regions but the real question is – what happens if this “doesn’t work”?

EUR tumbles (but only to one week lows)

Despite the uber QE, Bunds are disappointed with only a 10bps cut…

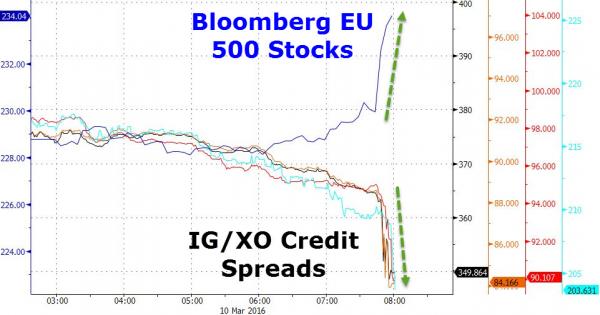

DAX is surging…

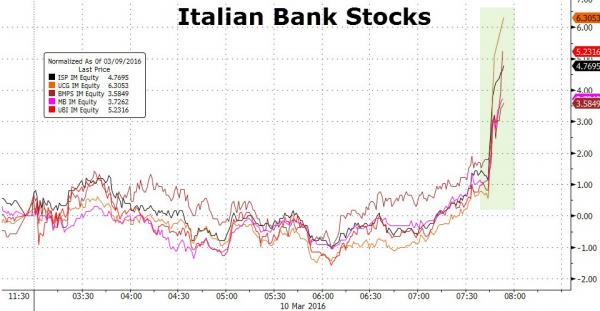

Bank stocks are soaring (led by limit-up moves in Italy)

Credit spreads are collapsing…

And of course, US equities are loving it… because all stimulus is fungible (and useless)

Charts: Bloomberg

Leave A Comment