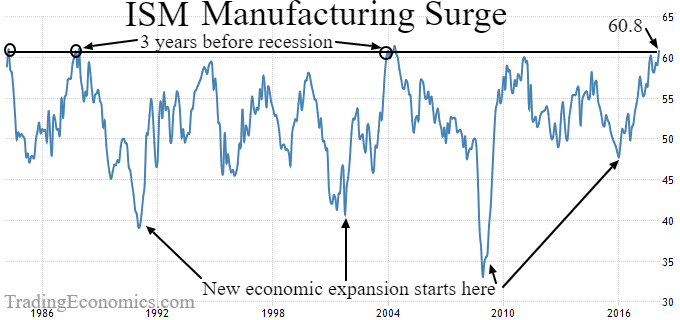

The larger service economy recovered years ago and remains strong, while the manufacturing world has only confirmed exceptional expansion rates over the the past year. The latest ISM Manufacturing Purchasing Managers Index (PMI) test of 61 is impressive and usually occurs in the early to middle innings of a new economic expansion following a recession. With low inflation, this new post election industrial surge is a good omen for the next couple of years and is being mirrored in Europe and to a lesser degree in Japan.

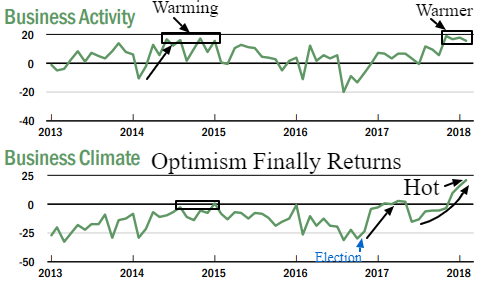

When Oil was pushing above $110 in 2014 the global economy was on the verge of breaking out, but recoiled as the excess Oil production glut and ensuing energy recession curtailed the building momentum. This time the industrial up cycle appears even warmer than in 2014 and 2010 as optimism pushes toward record levels.

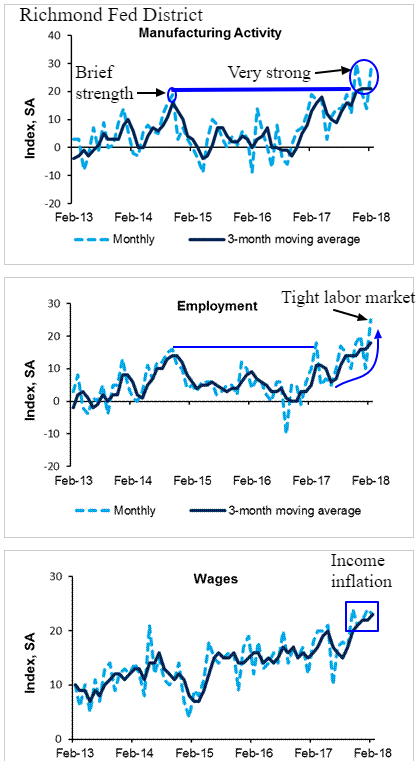

Drilling down further from the national ISM PMI data to the individual Federal Reserve Districts we can see specific aspects of strength. The Richmond Federal Reserve District report last week mirrors most parts of the US, revealing surging production and order demand that is severely straining supply chains and delaying deliveries. Unfilled orders are piling up as resource capacity limits the speed of desired growth rates. This is also a major factor limiting the economic growth rate and sustainability that Trump expects.

Along with decade highs in manufacturing activity we see extremely tight labor markets and rising wages. Bolstering this trend is the all time record population adjusted jobless claims and record unfilled jobs data that bolsters the hot labor market. Don’t be surprised if the current warm level of 2.9% wage inflation jumps a bit more in coming months pushing the 10 Year yield to just over 3%.

Our personal ExecSpec partnership supplying large machines around the world echoes the charts above as we experience record backlogs, slowing shipment dates and a severe scarcity of workers of all skill levels. About 12 months ago our machine manufacturing operation experienced the first dramatic order surge in a decade that has resulted in labor shortages along with constrained supply chain logistics that appears certain to remain an ongoing challenge in 2018 and beyond. Typically our personal expansion cycle surges last 3 to 4 years before hitting a wall. This targets ~2020, but signs of overheating will fine tune such forecasts over the next couple of years.

Leave A Comment