Business Investment Growth – Beige Book

The Fed’s Beige Book gives us great insight into why stocks have been volatile in October. The Fed used the word “tariff(s)” 51 times which is up from 41 in its previous report, making it the high of the year.

It’s worth noting the use of the word “trade” fell by about 10 to 12. The Fed used the word “concern(s)” 13 times which is the lowest since January. It was used it 10 times in January.

This implies the Fed is hawkish because it’s not worried about negative trends. I like the analysis of word usage because the Fed is extremely precise with its language.

Furthermore, we don’t know what the neutral rate is, so this analysis gives us further clarification into how hawkish policy is. Keep in mind, it’s important to look at a variety of words tested. The Fed talked less about trade, but more about tariffs.

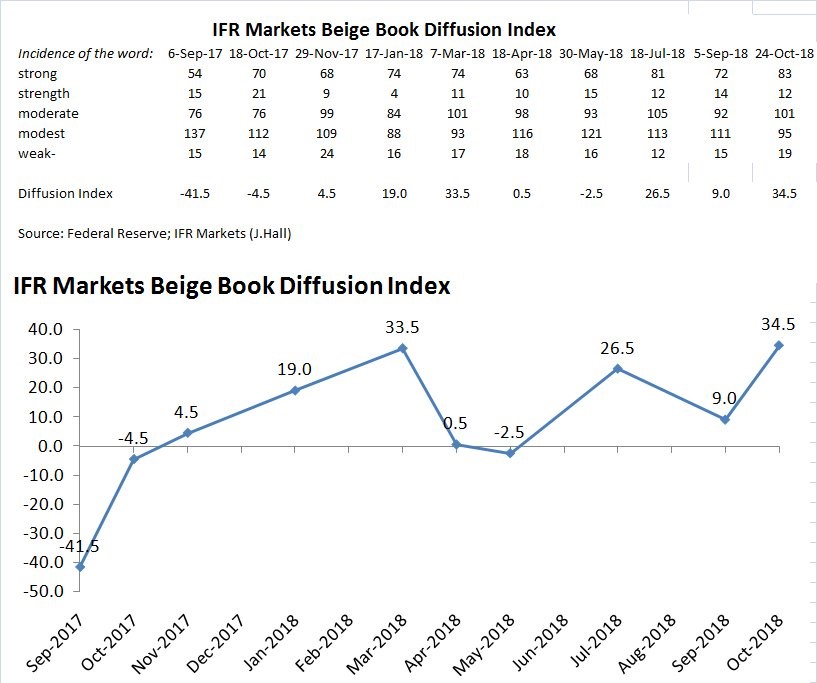

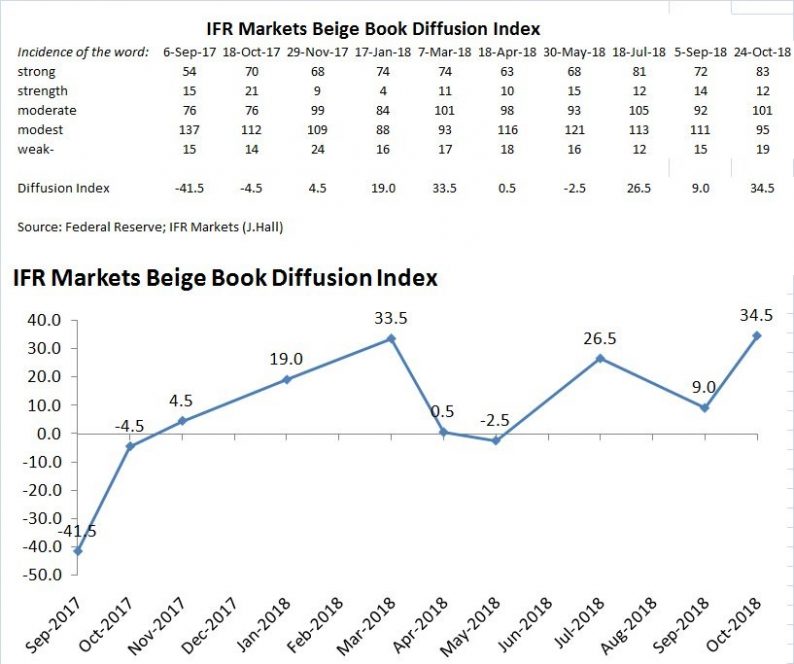

The chart below shows the Beige Book diffusion index which measures the usage of “strength”, “strong”, “moderate”, “modest”, and “weak.”

Negative readings indicate a dovish report. Weak economies are met with dovish policy. This includes rate cuts, holding rates below the neutral rate, and QE. It also can include slowing the unwind of the balance sheet.

In the current environment, the Fed won’t cut rates, but it could slow the pace of rate hikes.

The positive readings are hawkish. Strong economics are met with rate hikes and unwinding the balance sheet.

In the past couple of years, the Fed hasn’t been using QE to react to the economy. But I wouldn’t rule it out if the economy shrinks.

As you can see, current hawkishness is the highest in the last 13 months. It’s interesting to compare the stock market’s performance from October 2017 to October 2018.

This month has a hawkish policy and worse performance than last October. Obviously, that’s not the only change since last year. Now the economy must deal with tariffs. Last year, the economy was coming into tax cuts and now the effect of the stimulus is withering away.

Leave A Comment