“Much of what passes for orthodoxy in economics and finance proves, on closer examination, to be shaky business.” The Misbehavior of Markets – by Benoit Mandelbrot & Richard L. Hudson.

I’m concerned at this juncture for the “buy-and-hold” zealots.

I know, and respect, many of the disciples. I mean, I really like these professionals, study their work, but I implore them, venture outside the capital-asset pricing modeling box on occasion. Volumes of academic research exist that showcase how risk management (yes, selling and building cash), or lessening the impact of the math of losses shortens precious time required to break even and move forward.

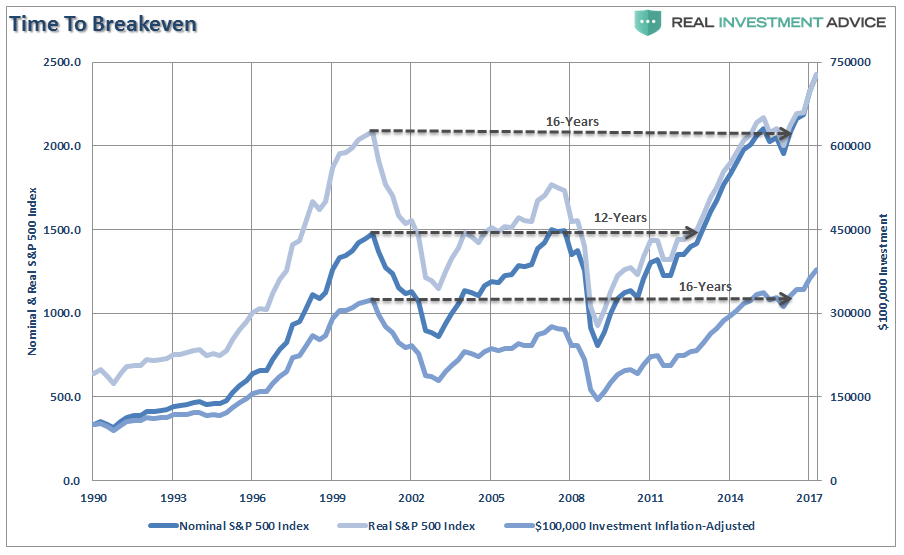

I don’t know about you but 12-16 years to get to back to where I was when I had less gray hair, appears to be more advantageous to Wall Street and the buy-and-hold fable than it does to my personal financial situation.

Yet, nothing deters this group. Time means nothing. It’s rarely discussed.

Listen, even Jack Bogle, founder of the temple – The Vanguard Group, the Jim Jones of the philosophy, has shared the news that stocks are “fairly-valued.” You see, “over-valued,” would have been too much of a stretch even though stocks are clearly such when the curtains of guesstimates are stripped away and financial alchemy is not considered.

Amazingly, Mr. Bogle did drop the “S” word, or “sell,” recently. Although as the exemplar of the buy-and-hold dogma, he warned that selling is never an all-or-none decision. You know, this I believe is a valid point.

Question: Why does this group believe investors are so dumb? In 28 years I’ve met a handful of investors who sold everything. Most of them bailed, went completely out of the market in 2007 (excellent timing), however, they never returned to stocks. Frankly, the market could deliver 50% compounded returns a year and they still won’t be back. They’re gone, gone, gone.

I’m chastened to inform you of those I encounter who have yet to recover from the tech bubble of 2000 (how many years have gone by? Count them. You’ll need a couple of hands and most of your toes), because brokers had them hold on although their portfolios were powder kegs of risk loaded underneath with dangerous concentrations in technology stocks disguised as diversification.

Unfortunately, these “professionals” tried to apply the buy-and-hold mantra round peg in a square and blew up people’s lives.

So, as professionals cop out with an exclusive buy-and-hold preach in your face, what they really mean is: “you’re just not smart enough to figure it out.” I call BS.

I have greater faith in individual investors than I do most professionals, especially through late-stage market sprints.

Every time I peruse the buy-and hold commentaries I feel like I’m watching the ugliest graduating couple making out on the dance floor on prom night. I mean it’s tough to look away however, I’m also wondering if these people understand how they appear to the poor saps who mistrust the stock market and don’t exactly share their blissful display.

It must be passive through-and-through or die because a discussion that introduces even the slightest degree of skepticism; forbidden words uttered like “there’s gotta be a better way,” gets one immediately blasphemed as a market timer. MT gets scarlet inked on your forehead.

Or worse, you’re permanently deemed a “perma-bear,” a “doomsday-er,” because you seek out and incorporate alternative opinions, some that admonish you against sitting at the lunch table with the popular kids.

Leave A Comment