The best income investments are stocks that currently pay a high yield and will also grow that dividend rate over time. With new companies that come to market, it is tough to time when the first dividend increase will occur. Usually, that first bump up in the payout comes within the first year after the IPO.

That first dividend increase can be a nice surprise for investors. The market often does not have any expectation of a dividend boost, so the announcement of a new, higher dividend rate can give a positive pop to the share price. I add new REITs to my database to keep track of their results and make projections about future dividends. Here are three (and one merger) that have come to market in the last year that may be announcing dividend hikes soon, as in the early months of 2016.

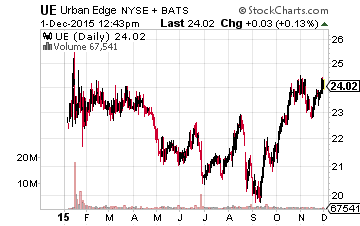

Urban Edge Properties (NYSE: UE) came to market with an early January 2015 IPO. The company owns retail shopping center properties in high barrier to entry markets. Over the first three-quarters of 2015, UE reported $0.90 per share or $0.30 per share per each of the three-quarters of recurring funds from operations (FFO). The initial dividend rate has been $0.20 per share per quarter. Same-store net operating income was up 4.1% in the third quarter compared to a year earlier. If Urban Edge Properties announces a dividend increase, I would expect something like a 5% bump. UE currently yields 3.3%, indicating the market thinks this is a high growth rate company.

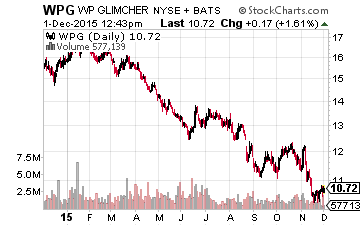

In January 2015, Washington Prime Group Completed the acquisition of Glimcher Realty Trust, with the merged company named WP Glimcher Inc. (NYSE: WPG). The company owns and develops enclosed regional malls, open-air centers and fashion outlets throughout the United States. The quarterly dividend rate has been set at $0.25 per share since the merger. For the 2015 third quarter, adjusted FFO was $0.46 per share. A dividend increase would be a way for the company to show investors that the merger was a success. The next dividend announcement should come in February 2016. WPG now yields 9.4%.

Leave A Comment