Earnings announcements for investors are like Santa Claus and birthday parties for kids, a lot of anticipation and full of surprises. Four times a year, publicly traded companies unwrap their quarterly finances for Wall Street to admire or criticize.

Each week this column will identify companies scheduled to release their quarterly report cards. The idea is to highlight stocks with the potential to pop or drop as investors react to results.

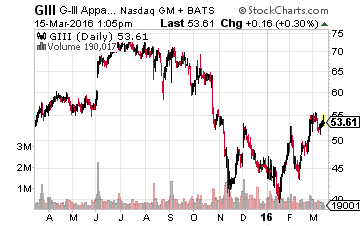

G-III Apparel Group, Ltd. (NASDAQ: GIII) –delivers ratios investors love.

G-III Apparel Group, Ltd. designs, manufactures, and markets women’s and men’s apparel. The company markets its apparel under brands you might recognize, such as ck Calvin Klein, Guess, Guess?, Kenneth Cole NY, Levi’s, and Tommy Hilfiger to name a few.GIII also has licenses with the National Football League, Major League Baseball, National Basketball Association, and National Hockey League.

Tentatively, I expect GIII to report 4th quarter results on March 22nd. Analysts believe the textile maker will earn $0.43 per share on sales of $573.01 million. Earnings-per-share (EPS) are projected to be lower than last year’s $0.49, but sales should best last year’s $514.32 million.

According to my calculations, G-III Apparel will earn $0.46 per share, a $0.03 bullish earnings surprise. Additionally, the Consumer Goods company generates an Earnings Power score of 10 (max score is 12.)

(Earnings Power is based on academic research. The study examined hundreds of financial ratios and determined that 12 are highly correlated with the bottom line i.e. predicting profits/losses. The final score measures changes in underlying fundamentals such as quarterly sales vs. inventory, assets and liabilities versus sales growth, return on assets, long and short-term debt, recent earnings revisions, income before extraordinary items and a few more, but you probably get the picture by now. Companies with higher scores are considered healthier than those generating lower scores.)

Leave A Comment