In the footnotes of my last post on factor investing I asked if I was being too skeptical:

Maybe I’ve read too much Carl Sagan who once said:

“If we are not able to ask skeptical questions, to interrogate those who tell us that something is true, to be skeptical of those in authority, then, we are up for grabs for the next charlatan (political or religious) who comes ambling along.”

This is a very stupid comment. There is no such thing as reading too much Carl Sagan. I also don’t think there’s such a thing as too much skepticism. So, now that I’ve laid the foundation to rip factor investing some more let’s get even more skeptical.

The 4 big factors are value, size, momentum and quality. Now, in my last post I said that the track record of factors isn’t very good. I cited the SPIVA scorecard which judges a lot of size and value funds. Admittedly, this is an imprecise measure as many of these funds do not implement these factors in standard ways. But since there haven’t been many live factor funds around it’s very hard to judge the performance so far. After all, we know these strategies work in the backtested hypotheticals, but making a strategy work in real-time is much more difficult.

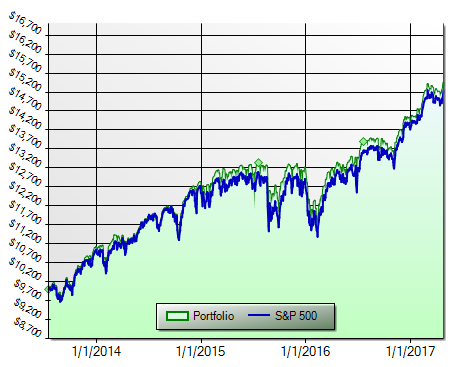

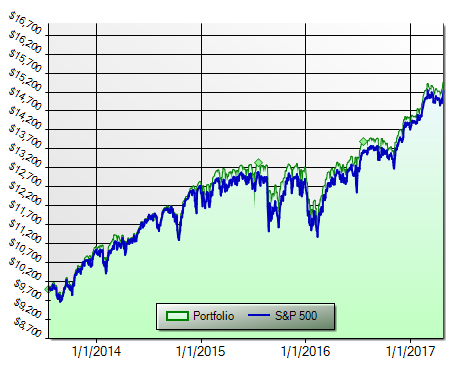

Now, in my last post I said that I am not against factor investing if it can be done in a tax and fee efficient manner. Turns out, we’re getting closer and closer to a point where we can actually judge some live factor funds over a decent time horizon. So, for instance, iShares has 4 big factor funds that are all very reasonably priced at 0.15% (VLUE, SIZE, MTUM and QUAL). If we equal weight them we have almost 4 years of performance to test. Here’s the result:

This makes sense. We own so many factors here that we start to look almost exactly like the S&P 500. On a risk adjusted basis you actually did slightly worse owning the 4 factor portfolio (Sharpe of 1.18 vs 1.2 for SPY). Still, the message is clear – if you own too many factors you start to look too much like the market cap weighted portfolio. This leaves us in a bind. If we can’t own them all then we need to pick the ones we think will create some alpha.

Leave A Comment