In their latest quarterly letter, Carlson Capital’s Black Diamond Thematic Fund (which was up 9.27% in Q4 and up net 19% in 2016) portfolio managers Richard Maraviglia and Matt Barkoff, who unlike Carl Icahn, Stanley Druckenmiller, Dan Loeb and most of the market, turned rather bearish weeks into the Trump victory, warn that “we may be looking at the grisly spectacle of stagflation”, echoing ongoing warnings from virtually all major banks that the market is wildly overpriced:

If the economy slows down against expectations it will have little effect on the upward direction of inflation. The rationale of inflation was cost-push and supply side constraints not demand side stimulus. Thus, we may be looking at the grisly spectacle of stagflation with the equity market on the highest cyclically adjusted valuations ever.

The two PMs are especially concerned about an imminent stagflationary episode, coupled with a concurrent recession, for the following reasons:

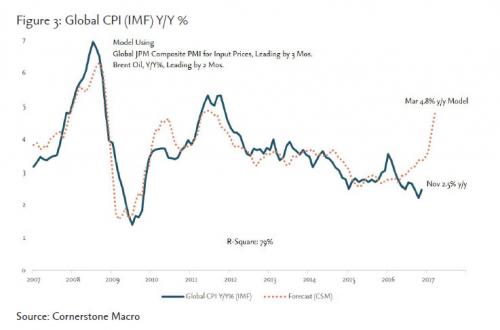

“Based on rising commodity prices and the more than one hundred percent year-on-year increase in crude oil, also an (OPEC) supply issue, we expect inflation to rise quite sharply perhaps as high as five percent over the next year. Anytime over the last thirty years that oil has risen one hundred percent year-on-year and long end interest rates are up one hundred percent year-on-year with a strong dollar, the US economy has slowed down often into recession. It squeezes consumer real purchasing power, slows real consumer spending at a time when export growth could slow given uncertainty over new, undecided policies and a less competitive currency. This is a global phenomenon; Japan has an extremely low unemployment rate too. The Eurozone and UK CPIs are destined to accelerate also.”

Needless to say the fund is bearish, and here is the reason why in its own words:

Politics and history feature heavily in our thinking as we begin the year. We see a variety of factors that could cause macro deceleration just at the moment when investors have been dragged kicking and screaming into cyclical positioning, a place in which they are not truly comfortable. We further see much more dramatic risk from China. The combination offers attractive optionality to defensive positioning that is now under owned and attractively priced. As it relates to the Trump rally, we could argue that there were several drivers. The first was seasonality into year end. The second was the enforced bond-equity rotation which we suspect could be over in the short term. Third, fourth and fifth would be policy themes: corporate tax reform, infrastructure spending and broad deregulation. It was notable that in his first press conference there was no mention of any of these but rather unprompted criticism of the pharmaceutical industry.

Setting aside intra-market rotations, we note that hedge funds are really long the market right now. Recent CFTC data showed large US futures buying by hedge funds. Net futures positioning is now above the 80th percentile. Recent prime brokerage data showed net leverage +6.5 percent above the trailing twelve month average and is now close to a twelve month high.

Leave A Comment