Central bank heads have been at it again last week. And they have clearly all been singing from the same hymn sheet. The messages have been very similar from the bosses of the Fed, ECB and BOJ. The head of the Swedish Riksbank had a different and much more interesting message. More about that later.

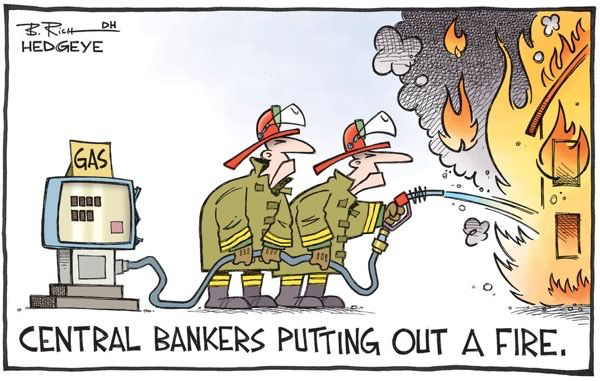

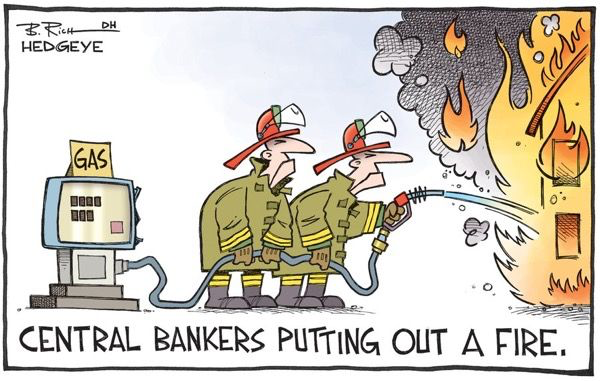

Why should we ever listen to any of these self-important central bankers. They are consistently inaccurate in their forecasts and policies. Their timing is always wrong as they are always behind the curve. More importantly they are distorting the natural economic cycles by artificial manipulation of markets and thereby creating booms and busts of an enormous magnitude. The natural laws of ebb and flow or supply and demand are the best regulators of markets. If the economy was allowed to take its natural course, the world would not experience massive bubbles and nor the economic troughs with severe recessions or depressions. Central banks and bankers should not exist. They fulfil no purpose and the world economy would function so much better without them.

DRAGHI WILL EAT HIS WORDS

So let us now have a look at what three “wise” bank heads told the world last week:

If someone wonders why I have used caricatures rather than real photos of these bankers, the reason must be obvious. No one must take a central bank head seriously!

Starting with the Fed chairman, Jay Powell, Wall Street did not like what they heard from him: “My personal outlook for the economy has strengthened since December”. He thus vowed to forge ahead with interest rate increases to avoid an “overheated economy”. This was interpreted as a much faster rate of increases than the market had expected. And stocks did not take kindly to his message. The Dow has fallen 1,300 points since his statement and stock markets around the world have followed. But this fall is just the beginning. More about that later.

Mario Draghi, the president of the ECB, said last Monday that slack in the Eurozone might be bigger than previously estimated and this could slow the rise of inflation but only temporarily and prices will eventually climb. He also said the factors that slow down the rise of inflation will wane as growth continues. A few days later he suggested that the ECB remains confident that inflation is finally on an upward trend which will permit the bank to end its bond purchases programme this year. He is likely to eat these words as the Eurozone financial system comes under severe pressure, starting with bank failures in Italy, Greece and Spain.

Finally Haruhiko Kuroda of the Bank of Japan (BOJ) joined the queue of the banks looking toward an exit of money printing. He stated that the BOJ will start thinking about how to end its monetary stimulus, beginning in 2019. The bank forecasts that inflation will reach its target of 2% in 2019.

Leave A Comment