The European Central Bank and the Bank of Japan have run out of “bullets” in their arsenal. They will continue to cut interest rates further ‘below zero’, but that is not taming the ‘Beast of ‘Deflation’.To the global community, it is evident that this is not continuing to prop up the stock markets any longer. How can they be expected to be trusted, anymore?

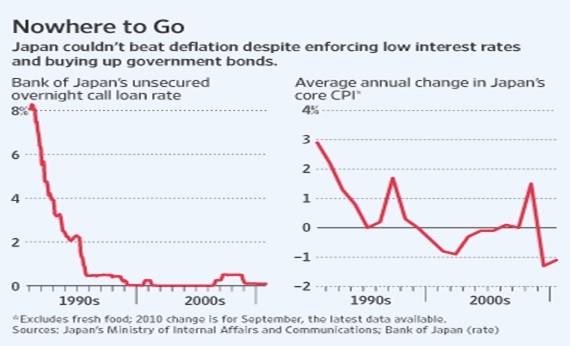

Take a look at the Bank of Japan which started QE in 2001. It’s still in deflation!

World Leaders Struggle For Control of the Financial Markets

As of today, I have no doubt that the ECB President Mario Draghi is backpedaling on his statement regarding no further easing which will be contemplated. He is now stating “whatever it takes”.

The ‘monetary easing’ in Europe, Japan and China are placing us even further into a ‘black hole’. There are no more tools left in the tool box that may somehow magically appear.I am confident that the FED will not ‘materially’ raise their short term interest rates over the next two or more years.

Alan Greenspan recently stated that the Fed cannot exit its era of ‘Quantitative Easing’ without any serious repercussions. Greenspan warns that there will be a “significant market event.”

The last crisis struck investors without any warning. So consider yourself forewarned by one who has over 35 years of experience in the financial market arena.

Wake up America! Warning signs are abundant, however, there is one sign that even the most complacent of all investors cannot ignore.

The banks of the world are now preparing for the biggest crisis in history.They call it the ‘BAIL-IN’. There was a paper prepared by the Federal Reserve Bank of New York in December of 2014. It was written by Joseph H. Sommer, a member of the Federal Reserve’s legal team. It specifically indicates that bank deposits are bank liabilities which are clearly affected by a bankruptcy. Your deposits are loans to the bank of which they can default on repayment, in the event of bankruptcy.

Leave A Comment