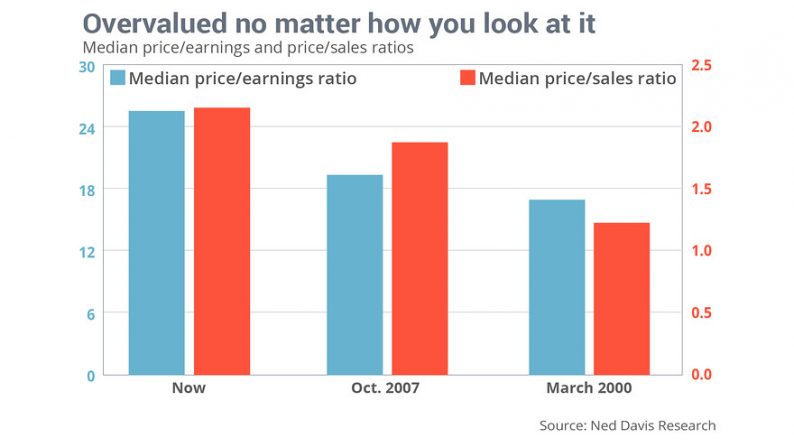

The stock market currently is even more overvalued than it was at the bull market peaks of both March 2000 and October 2007 — according to not just one, but two, valuation measures.

That at least is the message of an analysis released earlier this week by Ned Davis Research, the quantitative research firm. What caught my eye in the firm’s analysis was that, unlike virtually all others that conclude that stocks are overvalued, this one was not based on the so-called Shiller P/E — the cyclically-adjusted P/E ratio championed by Nobel laureate Robert Shiller of Yale University.

That’s noteworthy, since there would be nothing new in reporting that Shiller’s P/E shows stocks to be overvalued. That ratio has been giving this same message for several years now, and skeptics have found many ways of wriggling out from underneath its bearish implications.

Continue reading at MarketWatch.

Leave A Comment