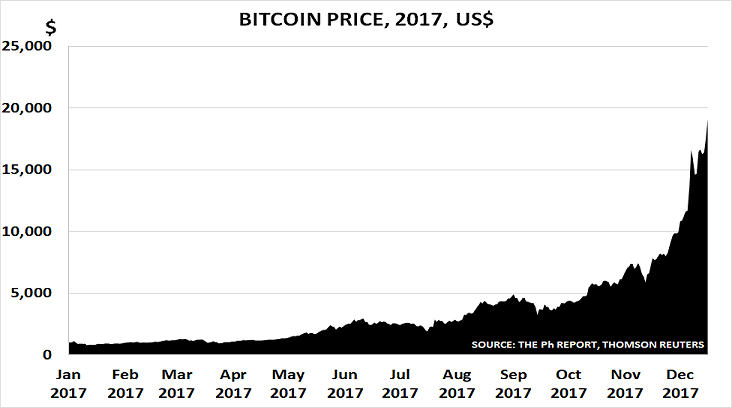

Last year it was the near-doubling in US 10-year interest rates. In 2015, it was the oil price fall. This year, there is really only one candidate for ‘Chart of the Year’ – it has to be Bitcoin:

The beauty of the concept is that nobody really has a clue about what it is all about. You can read the Wikipedia entry as many times as you like, and still not gain a clear picture of what Bitcoin is, and what it does. But why would you want to know such boring details?

All anyone has to know is that its price is going higher and higher. Plus, of course, there is the opportunity to laugh at stories of people who bought Bitcoins, but then lost the code – for an excellent example by a former editor of WIRED (with a happy ending), click here.

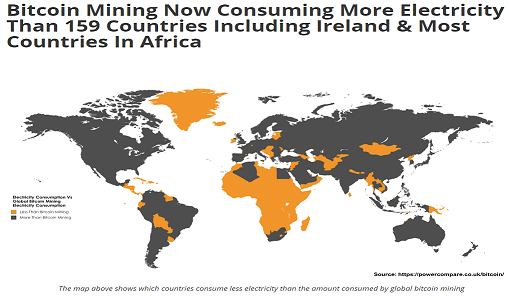

But there is another side to the story, as the second chart suggests. “Mining” Bitcoins now uses more electricity than a number of real countries, like Ireland, for example:

And, of course, interest is growing all the time as people rush to get rich. Today sees the start of Bitcoin futures trading on the CME, a week after they began on the CBOE and CME. Bloomberg suggests Exchange Traded Funds based on Bitcoin will be next. In turn, these developments create more and more demand, and push prices ever-higher.

Comparisons have been made with the Dutch tulip mania in 1836-7 when prices peaked at 5200 guilders. At that time, Rembrandt’s famous Night Watch painting was being sold for 1600 guilders, and at its peak, a tulip bulb would have bought 156000lbs of bread. Bitcoin probably won’t equal this ratio until next year, if its current price climb continues.

Leave A Comment