The market may have peeled back off of its highs hit last week, but even with that dip the S&P 500 (SPX) (SPY) managed to close on Friday a solid 2.0% better than where it ended the prior Friday.

It remains to be seen if stocks can sustain the uptrend; there are strong technical arguments from both sides of the fence. The good news/bad news is, things should come to a head this week and force the bulls and the bears to play their hand. Once they do (for better or worse), the market will get much more interesting and trade-worthy again.

We’ll hash out the details after running down last week’s and this week’s key economic data.

Economic Data

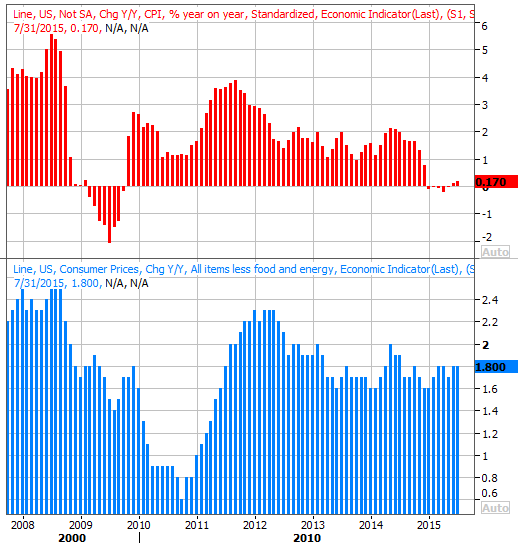

Not only was last week rather light in terms of economic news, little of what we got was of any real interest. In fact, the only data worth exploring was August’s inflation data. It’s still tame, at an annualized pace of 0.17%, and on a core basis (without food and energy) it’s still a manageable rate of 1.8%. It’s still below the Fed’s target rate of 2.0%, giving the Fed room to hold off on a rate hike this week… if Janet Yellen wanted to.

Inflation Chart

Source: Thomas Reuters

There was a sharp plunge in the Michigan Sentiment Index’s first reading for September. The dip from 91.9 to 85.7 is the sharpest drop in years, and the lowest reading in months. But, in that it’s the first of three updates to the index, it’s too soon to snap to a conclusion there.

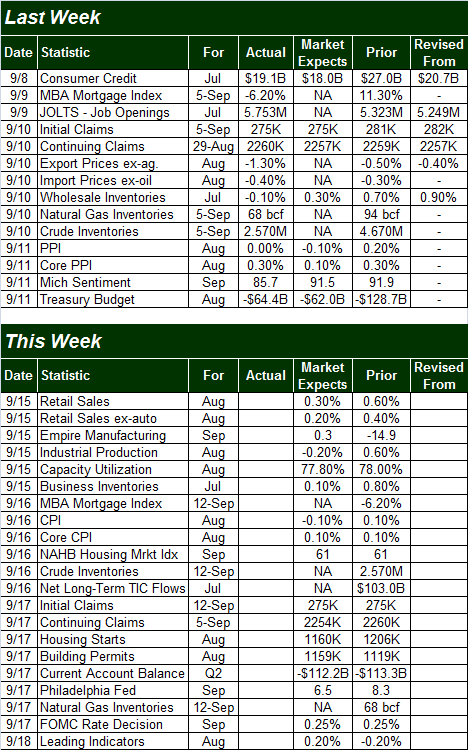

Everything else is on the following grid:

Economic Calendar

Source: Briefing.com

This week is clearly going to be significantly busier, but two of the items particularly stand out.

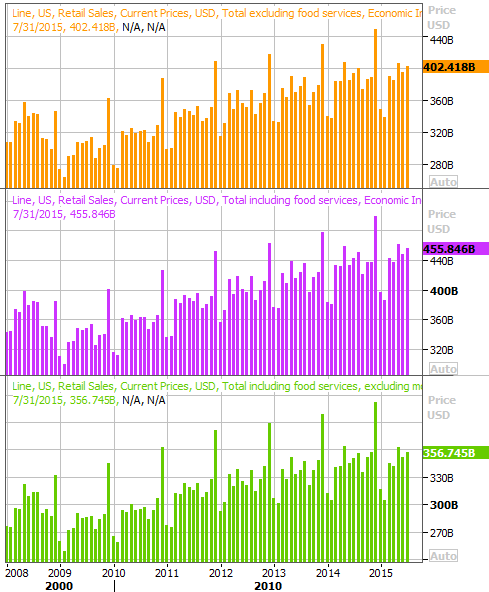

The first of those items is Tuesday’s retail sales data for August. Economists are calling for a slowdown from July’s sales, though the growth figures should still be positive… sustaining a longer-term growth trend.

Retail Sales Chart

Source: Thomas Reuters

The other data set we’ll be watching closely is last month’s housing starts and building permits. They’ve both been wild of late, though each has remained in long-term uptrends. Last month’s numbers are projected to be pretty similar to July’s, but a big beat or shortfall could shake the market up a little.

Leave A Comment