U.S. DOLLAR SELL-OFF FINDS BOUNCE AT THREE-YEAR LOWS

Last week saw another extension in the sell-off that started in the U.S. Dollar in the first week of last year. And while that trend remained rather smooth in southbound direction for the first nine months of 2017, a bit of support had started to show in Q4 as we moved towards year-end, giving rise to the idea that a move of strength might transpire, even if only temporary, as shorts closed up positions while taking off risk in key areas like the topside of EUR/USD or GBP/USD.

That never really happened. We did get a bit of a pullback in October and the first half of November, but sellers came-back rather quickly and soon punched the Greenback down towards those three year lows as we moved to close out 2017. And once 2018 opened-up, the selling really got underway, marked by last week’s aggressively bearish move on the heels of some comments from U.S. Treasury Secretary, Mr. Steven Mnuchin. This brought the U.S. Dollar down towards a key area of support, the 61.8% retracement of the 2014-2017 bullish move, which started to show on Friday. As we open this week, the Dollar is continuing to claw back recent losses as a big week of economic data is on the calendar, with high-impact U.S. economic items being released every day of this week.

U.S. DOLLAR WEEKLY CHART: EXTENSION OF 2017 SELL-OFF

Chart prepared by James Stanley

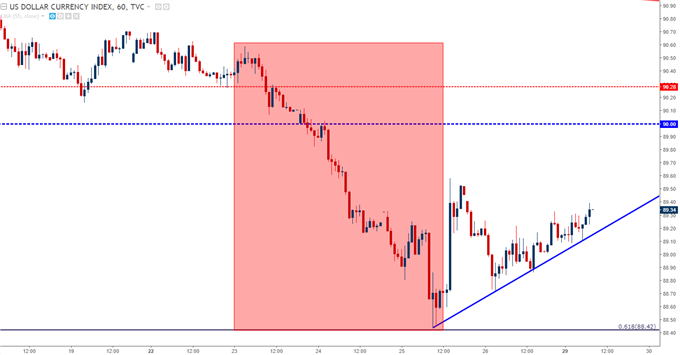

This rally off of the lows still appears corrective in nature, with potential resistance at 89.50, around last week’s swing high, followed by the psychological level of 90.00.

U.S. DOLLAR VIA ‘DXY’ HOURLY CHART: CORRECTIVE MOVE FOLLOWS SELL-OFF

Chart prepared by James Stanley

A BUSY ECONOMIC CALENDAR AWAITS

Below, we’re looking at this week’s high-impact data prints taken from the DailyFX economic calendar. Notice the heavy emphasis on US data, but also some key European prints on Tuesday and Wednesday, along with Australian CPI tomorrow night (Wednesday morning in Australia, Asia). On the U.S. front – the FOMCrate decision on Wednesday brings a very small probability of any actual moves, with markets continuing to carry a sub-5% chance of a hike. The next Fed decision in March should be considerably more interesting, as this will be Mr. Jerome Powell’s first as the head of the bank, along with the fact that there’s currently a 78% chance of an interest rate hike.

Leave A Comment