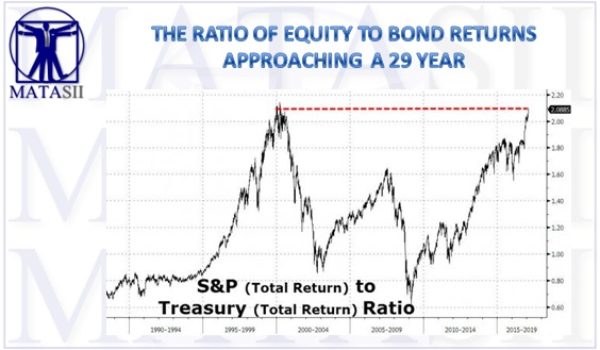

Why are we getting such diverging and maddening market messages from the equity and bond markets? Which one is right? Are either right?

MARKET PERCEPTIONS

Let’s consider the perceptions of each of these markets:

EQUITY MARKET

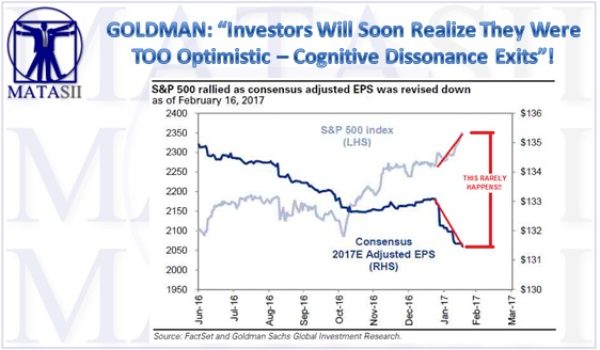

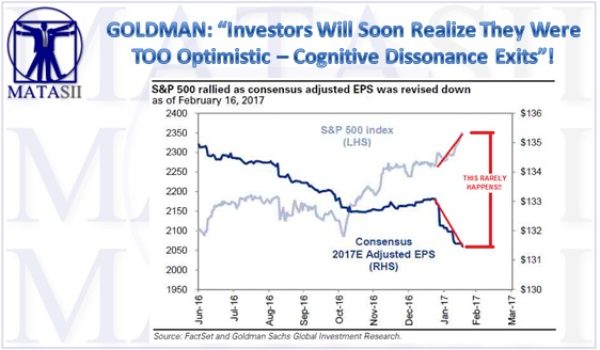

The Equity Markets perceives Trumponomic Policy SUCCESS ahead and are aggressively pricing it in!

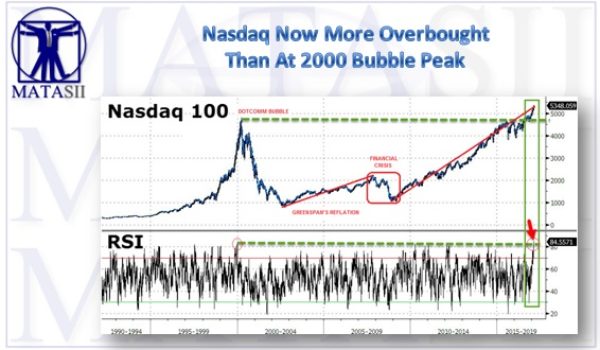

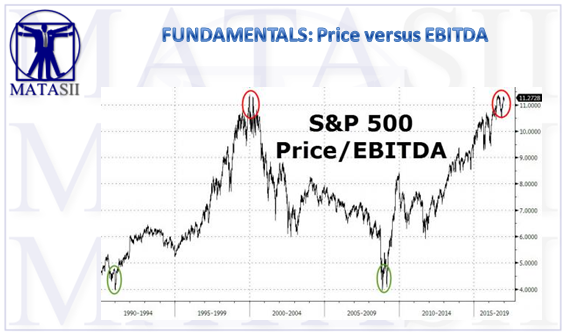

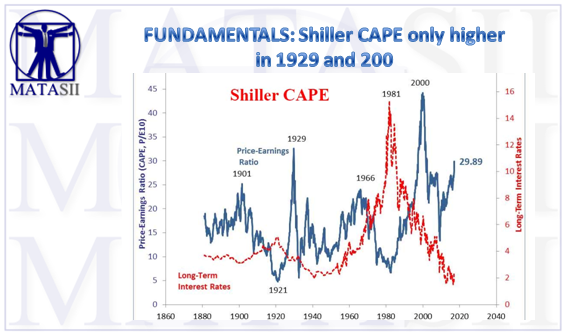

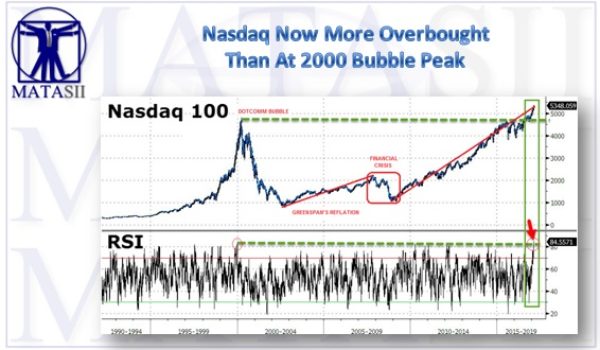

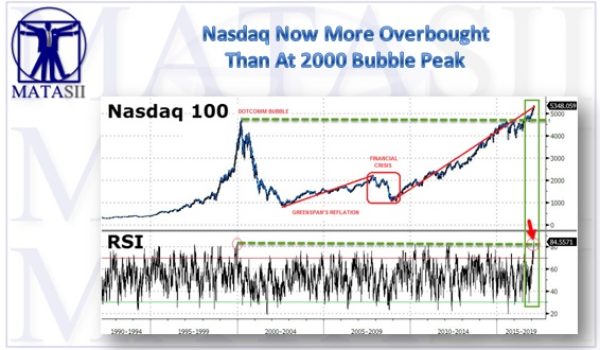

The level of excitement has now reached the levels that it can safely be categorized as EUPHORIC.

BOND MARKET

The perception of the Bond market is the REALITY of whether Trumponomic Policy will actually be implemented and within expected time frames investors mistakenly believe will happen.

The level of concern can be safely categorized as CAUTIOUS.

CORE QUESTIONS ON THE TABLE

Maybe the real underlying questions that need to be answered by thoughtful investors are the following:

WHAT exactly are the details of the Trumponomic Policies? We have a lot of populist rhetoric, but as of yet we have little tangible detailed substance. The devil always lies in the details!

IF in fact these policies can actually be implemented based on a clearly hostile democratic party within congress as well as significant conflict within the GOP from staunch fiscal conservative members and the Tea Party advocates.

WHEN these policies can be implemented is a the major unknown? There is a congressional sequence that must be followed so that an encompassing congressional budget bill can be passed. The reinstatement on March 15th of the Fiscal Debt Ceiling is not a small hurdle to be overcome nor the creative ways the Democratic Party will do everything its power to derail and slow any implementation!

RESULTS are also a major unknown. The Fiscal Stimulus, Tax Cuts and Regulatory Reduction all play well as populist policy and did work during the Reagan Administration, but will they actually work today? Many including Reagan’s OMB Director, David Stockman vehemently say they won’t.

Leave A Comment