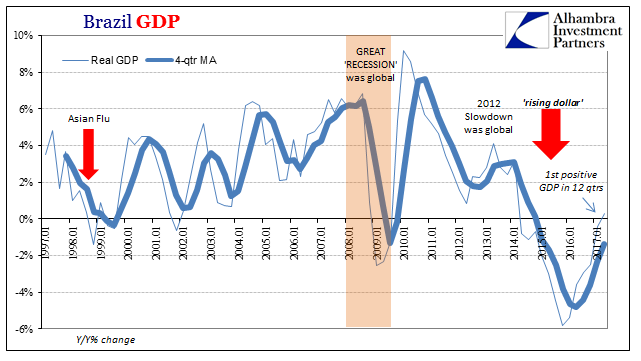

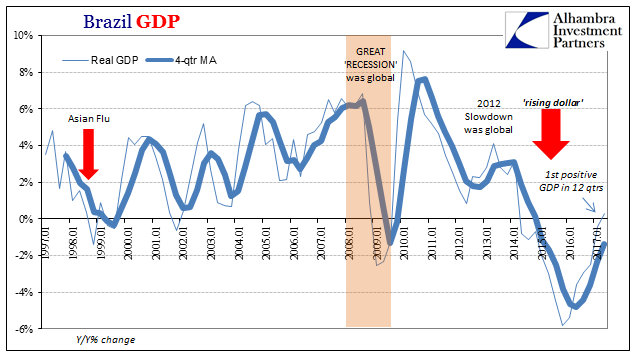

Of all the countries around the world impacted by the “rising dollar”, Brazil got the worst of it, at least out of the major economies. What Brazilians have experienced over the past four years is nothing short of 1929-style collapse. By every economic statistic, that economy has been utterly devastated.

In Q2, however, real GDP rose year-over-year for the first time in three years. Not since economists here in the US tried to make sense of 2014’s Polar Vortex has Brazil’s measured output increased. That confusion and Brazil’s sudden downward lurch were actually quite related.

In the linear orthodox world of recession (or outright depression)/not recession, that must mean recovery and relief has started? Unfortunately no.

So far what is indicated is what we find everywhere else in the world in the aftermath of this global downturn 2015-16. The contraction ends, but only listless, meandering partial growth thereafter. There is no momentum or positive cyclical contributions, and especially none like you would expect after three years of serious contraction. By all historical experience, Brazil should be booming by now.

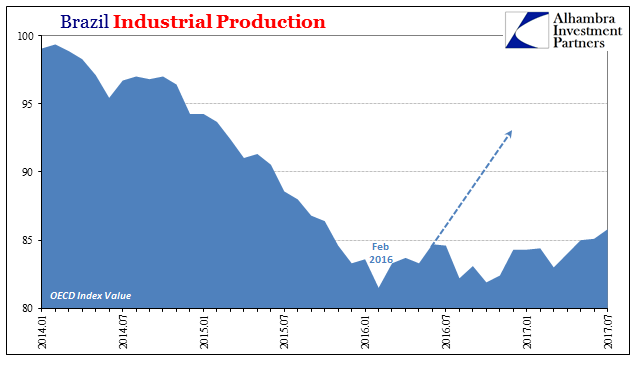

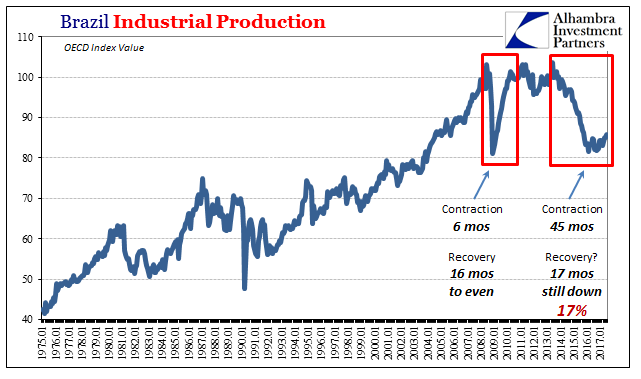

Industrial production, the bedrock of the Brazilian resource economy, is perhaps the perfect illustration of all this that is missing. In domestic as well as international estimation, the trough of Brazil’s contraction was the same as we find everywhere else around the globe – February 2016.

The total decline from the peak in June 2013 was an unfathomable 21.4%. What really makes it so is the time element. During the worldwide Great “Recession”, IP collapsed by a similar amount, down 21.2% peak to trough but only 6 months top to bottom. It took the next 16 months for industrial output to regain that prior peak.

It has been 17 months since the more recent bottom, and yet Brazilian Industrial Production remains 17% less than the peak four years before. The series has returned to growth, but in an unusually shallow manner not just set against the preceding contraction but for any other context, as well. This is the condition with which the world economy has become far too acquainted.

Leave A Comment