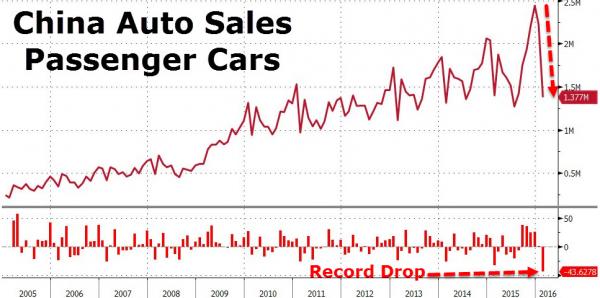

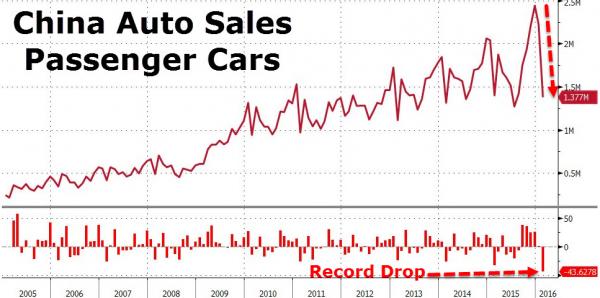

The dream of transition to a ‘consuming’ economy just crashed into the wall of excess debt and leverage. 2016 has started with a 44% collapse in China passenger car sales. This is the biggest sequential crash and is 50% larger than any other plunge in history.

While there is a seasonal effect here obviously, the sheer scale of this 2-month drop – which removes the new year holiday affect – indicates something is terribly wrong in China.

Coming at a time when vehicle inventories are near record highs relative to sales with a mal-investment-driven excess inventory-to-sales at levels only seen once before in 24 years…

And worse still, used car prices starting to fade rapidly (biggest Feb drop since 2008)…

Falling used car prices means pressure on new car prices as well, which would be a shock to America’s booming auto market.

Obviously, the scariest part about all of the above is that consumers still have the pedal to the metal (pun fully intended) when it comes to leases, which means there’s no end in sight to the off-leases and thus no way to determine, at this juncture, how big the residual writedown wave and deflationary auto industry calamity will ultimately end up being.

So, you know… “buckle up.”

***

Simply put, the world’s automakers – all toeing the narrative line that growth will be from China – now face a harsh reality of massive mal-invest

Leave A Comment