Yesterday, we suggested that the most important question wasn’t whether the Fed would put a dovish spin on the June hike, but rather whether China would follow up with their own hike hours later.

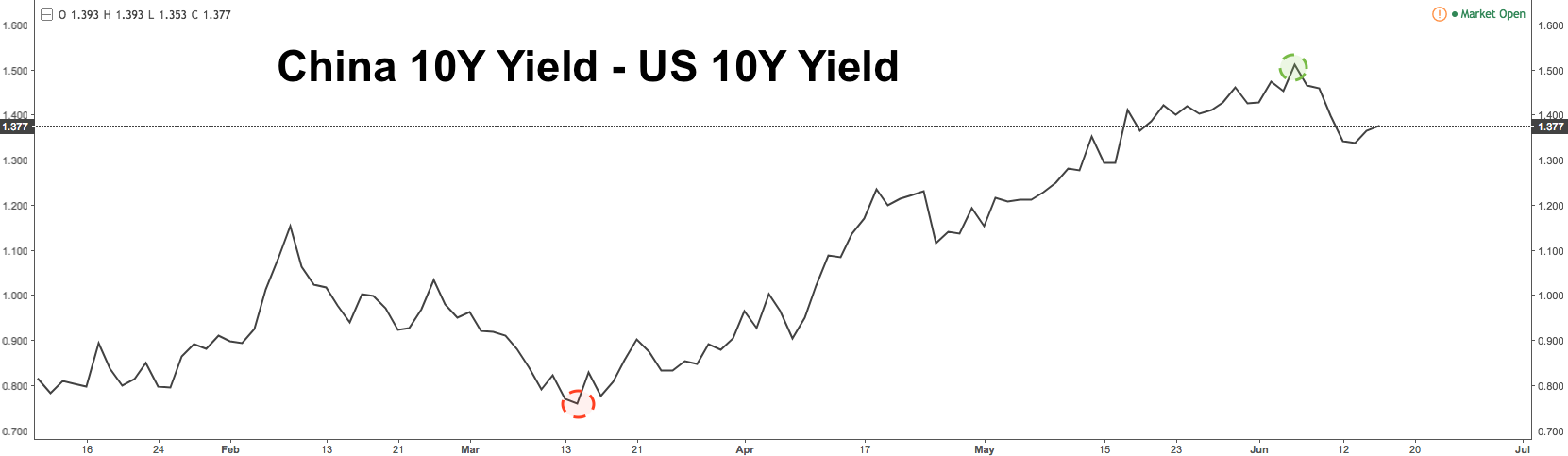

The risk, you’re reminded, is that if China doesn’t effectively “call” the Fed (like they did in March), then rate differentials compress, sparking a weaker yuan and capital flight.

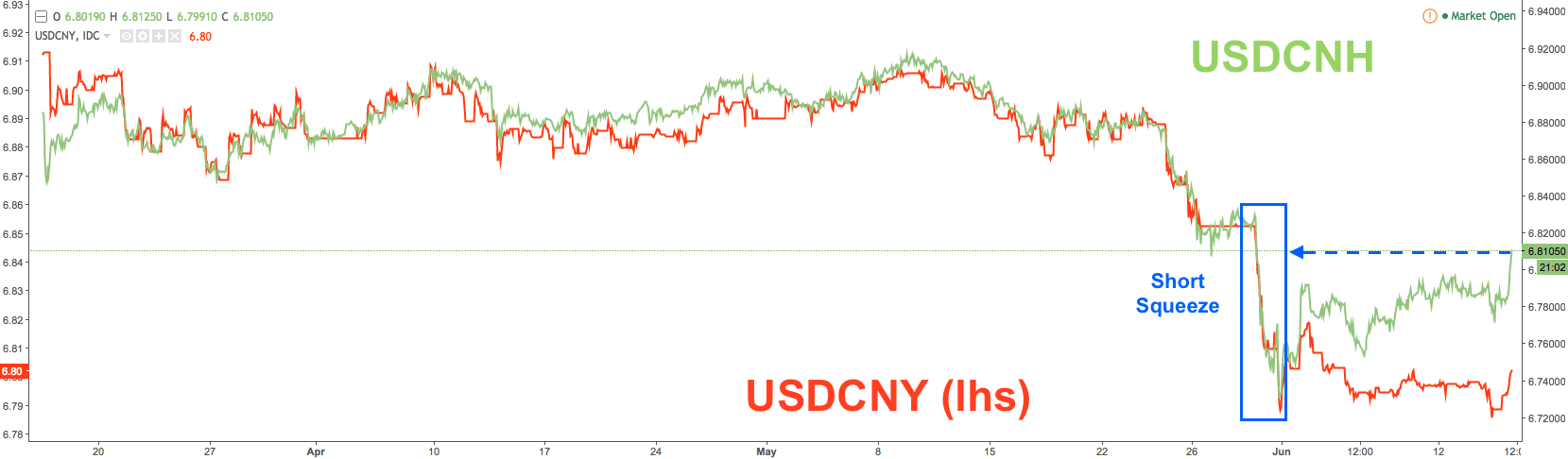

Seen in that light, the move to add a counter-cyclical adjustment factor to the yuan fix last month (and the attendant short squeeze it triggered), might have been an effort to get out ahead of the Fed.

The risk on the other side (i.e. the risk of hiking OMO and MLF rates) is that you exacerbate the shadow unwind with God only knows what consequences.

Overnight, China did indeed refrain from hiking and the rationale seems to be precisely what we discussed on Wednesday: rate differentials and the stronger yuan.

“The People’s Bank of China kept rates unchanged in its open- market operations on Thursday,” Bloomberg writes, adding that “the yield gap between U.S. and Chinese 10-year sovereign bonds widened to a two-year high of 150 basis points on June 6, compared with less than 90 on March 15.”

That said, the PBoC probably shouldn’t get too comfortable because the yuan is falling fast both onshore and offshore where USDCNH has recovered almost all of its post-short squeeze losses:

More color below…

Via Bloomberg

Leave A Comment