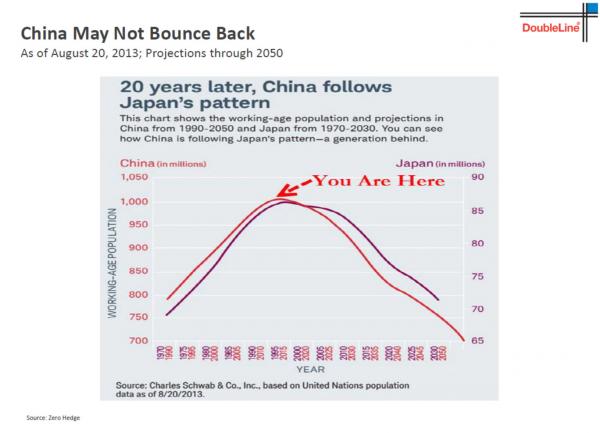

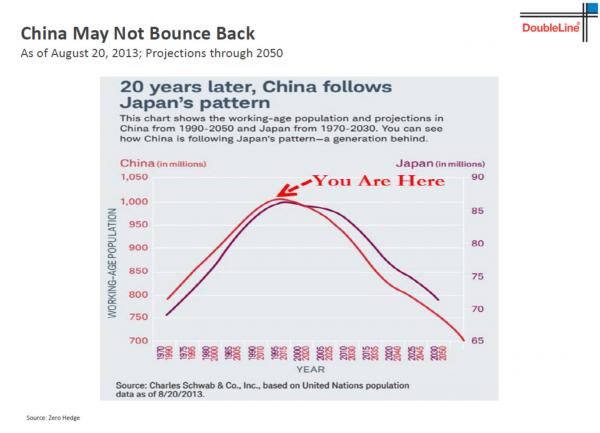

In an odd coincidence, just as we were preparing an article showing how China is becoming increasingly more like Japan and hot to trade this convergence, we happened to glance at the slide that Jeff Gundlach was talking about at that exact same moment during his afternoon presentation, and lo and behold, the “new bond king” was discussing why, among the reasons why “China may not bounce back”, is that China is increasingly becoming a Japanese demographic doppelganger…

… in a slide that was sourced from, of all places, Zero Hedge.

So with that reflexive quandary out of the way, we go to the latest presentation by BofA’s Michael Harnett, who among the 6 key investment themes and trades for 2016″ lays out the “Black Dragon” as one of the key ones, and one whose core thesis is that “China, like Japan in the early-1990s, has entered a secular period of significantly slower economic growth, compounded greatly by debt deflation;like Japan in the 1990s, Chinese asset prices, currency, banks (Chart 5) and capital flows will periodically cause severe disruptions to global financial markets, even if China does not itself cause a global recession.”

In other words, China is Japan, and not just demographically but financially as well.

This is what else Hartnett said:

China has de-pegged its currency from the US dollar: history is replete with illustrations of how major FX regime changes cause cross-asset volatility: Britain’s departure from the gold standard (1931), collapse of Bretton Woods system (1971-3), UK ending ERM membership (1992), Asia crisis (1997-8), the Euro (2000-).

Why

China = Japan: China, like Japan in the early-1990s, has entered a secular period of significantly slower economic growth, compounded greatly by debt deflation; like Japan in the 1990s, Chinese asset prices, currency, banks (Chart 5) and capital flows will periodically cause severe disruptions to global financial markets, even if China does not itself cause a global recession.

Chinese devaluation: a cyclical collapse in export growth, extreme FX devaluations in recent years in Japan, Europe and across Emerging Markets, and capital flight, are all causing an accelerated devaluation of the Chinese yuan; BofAML forecast CNY6.9 and CNH7.0 by 2016 year-end; we see downside risk to these forecasts (n.b. PBoC has spent $200bn in reserves in past two months and yet the extent of private capital outflows means CNY has still fallen).

The great EM devaluation: until there is two-way risk in RMB, there is one-way risk in oil, commodities and EM; once Chinese exports begin to react positively to the cheaper currency, we think a bid is likely to return to Chinese and EM assets; until then, China asset prices are a threat to global asset prices (n.b. Chinese corporate bonds are at multi-year highs despite a credit crunch).

Leave A Comment